CNOOC Limited released its 2025 interim results, announcing a 6.1% year-on-year increase in net production, reaching 384.6 million barrels of oil equivalent (boe). Net profit attributable to shareholders stood at RMB69.5bn ($9.54bn), reflecting stable profitability. The Chinese company also declared an interim dividend of HKD0.73 ($0.093) per share.

Reserve development and geographical diversification

In the first half of the year, five new oil and gas discoveries were made and eighteen bearing structures were appraised. Key discoveries included Jinzhou 27-6 and Caofeidian 22-3 in offshore China. Internationally, CNOOC Limited expanded its footprint by signing an oil exploration contract in Kazakhstan and continued developing reserves in Guyana.

Major projects launched in China and Brazil

Ten projects were brought online, including Bozhong 26-6 (Phase I) and Wenchang 9-7 in China, as well as Búzios7 and Mero4 in Brazil. Natural gas output grew by 12%, supported by the ramp-up of Shenhai-1 and Bozhong 19-6 fields. The Shenhai-1 Phase II project is expected to produce more than 4.5 billion cubic metres annually, making it China’s largest offshore gas field.

Digital technologies and cost control

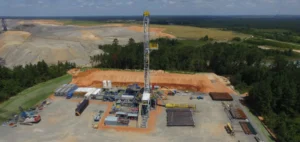

The company accelerated its digital transformation by deploying large-scale smart technologies for drilling and production, helping reduce the natural decline rate in offshore fields. The all-in cost per barrel remained flat at $26.94 despite market volatility. Use of artificial intelligence and satellite-based sensors enhanced risk management, particularly against typhoon threats.

Pilot projects in green energy and CCUS

CNOOC Limited generated over 900 million kWh of green power and consumed 500 million kWh from renewable sources during the period. The Qinhuangdao 32-6 field saved approximately 18 million kWh through improved energy management. On the Enping 15-1 platform, the company launched China’s first offshore carbon capture, utilisation and storage (CCUS) project.

According to Zhang Chuanjiang, Chairman of the Board, the company will continue its expansion strategy while securing operations to meet annual offshore energy development targets.