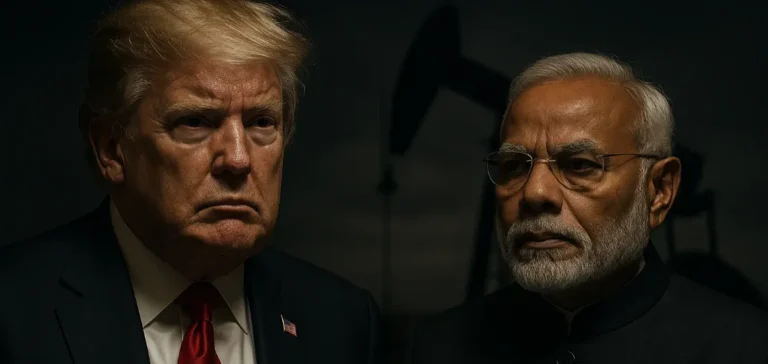

India is preparing this week for the implementation of 50% US tariffs on its exports to the United States. Washington’s decision aims to penalise New Delhi for its imports of Russian oil, which are considered an indirect support for financing the war in Ukraine. US President Donald Trump confirmed that the measure would take effect on Wednesday, unless a last-minute change is announced.

A vital market under threat

The United States is the largest destination for Indian exports, totalling $87.3bn in 2024 according to trade data. A 50% tariff increase is equivalent to a near embargo on low-margin Indian products, according to analysts at financial services group Nomura. Garima Kapoor, from Elara Securities, said that no Indian company could maintain any competitive advantage under such a barrier.

The textile, seafood and jewellery sectors have already reported mass cancellations of US orders, with rivals in Bangladesh and Vietnam benefiting instead. According to forecasts by S&P Global, the measure could subtract between 70 and 100 basis points from India’s gross domestic product (GDP), pushing its growth below 6%, the lowest level since the Covid pandemic.

Pharmaceuticals and electronics temporarily spared

Some sectors, particularly pharmaceuticals and electronics, are currently exempt from the tariffs. The production of iPhones in India for Apple has been explicitly excluded from the US decision. This limited exemption may partly mitigate the economic impact, but experts believe that most of the bilateral trade will remain affected.

Washington has justified the sanction by accusing India of acting as a “global laundering office for Russian oil,” according to White House trade adviser Peter Navarro. Indian Minister of External Affairs Subrahmanyam Jaishankar responded that Indian imports stabilise global crude prices and have been known and accepted by Washington since 2022.

Closer ties with China and BRICS

In response, New Delhi has stepped up diplomatic contacts with its BRICS partners (Brazil, Russia, China, South Africa). Prime Minister Narendra Modi is scheduled to travel to Beijing this week, while support measures for Indian exporters worth $2.8bn are being prepared. The government is also considering tax cuts on essential goods to protect domestic consumption.

Bilateral negotiations between Washington and New Delhi remain stalled, with discussions blocked on access to India’s agricultural and dairy markets. US officials cancelled a planned visit of their negotiators to India, but Subrahmanyam Jaishankar said that “negotiations are continuing,” without providing details on a possible breakthrough.