Viper Energy, Inc., the publicly traded subsidiary of Diamondback Energy, Inc., has finalized the acquisition of Sitio Royalties Corp. This transaction, previously announced, has now closed with immediate effect as of August 19, 2025. The deal aims to strengthen Viper’s position in the oil and gas royalties sector, a segment that generates stable cash flow and is decoupled from operated asset structures.

This acquisition directly impacts the production outlook for the third quarter of 2025. Diamondback Energy has revised its quarterly guidance upwards, accounting for 43 days of operational contribution from the newly acquired assets. The group’s net production is now expected to range between 908 and 938 thousand barrels of oil equivalent per day (MBOE/d), compared to an initial estimate of between 890 and 920 MBOE/d.

Production increase expected after asset integration

On Viper Energy’s side, net production is anticipated to be between 104.0 and 110.0 MBOE/d. As for crude oil production alone, Viper’s forecast now stands between 54.5 and 57.5 thousand barrels per day (MBO/d), a growth attributed to the immediate contribution of Sitio Royalties’ assets. For Diamondback Energy, crude oil production has also been revised upward, reaching a range of 494 to 504 MBO/d, compared to the previous 485 to 495 MBO/d.

The company has not released updated annual forecasts. It stated that new projections for the full fiscal year 2025 will be shared with the release of third-quarter results, expected in November.

Asset consolidation in oil royalties

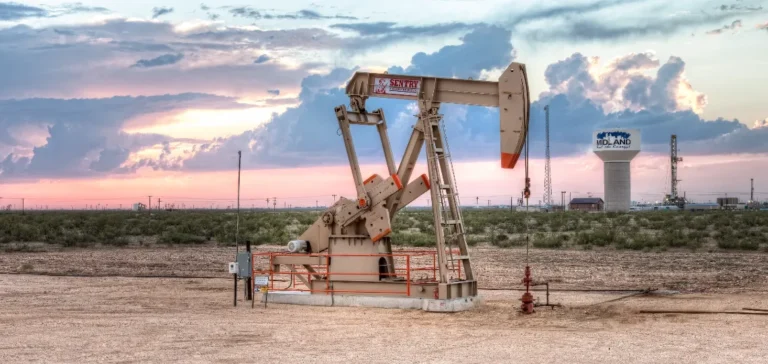

The integration of Sitio Royalties’ assets reinforces Viper Energy’s strategy, which focuses on acquiring and managing non-operated mineral interests. These rights offer direct exposure to production without operational responsibility, allowing companies like Viper to optimize returns without engaging in the direct exploitation of reserves.

This transaction takes place in the context of continued consolidation in the U.S. fossil energy sector, where operators seek to secure revenue streams and reserves by leveraging already-producing assets. No additional financial details regarding the acquisition amount or terms were disclosed in this update.