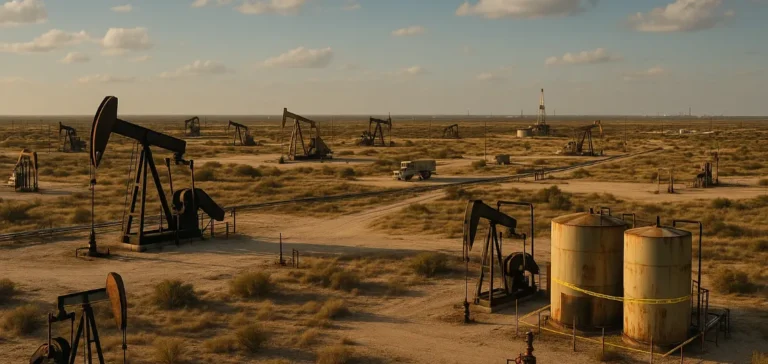

Permian Basin Royalty Trust (PBT), managed by Argent Trust Company, declared a cash distribution of USD 0.012976 per unit, payable to unit holders recorded as of June 30, 2025. This distribution, payable on July 15, 2025, does not include revenues from Waddell Ranch properties, where production costs still exceed gross proceeds.

Complex situation at Waddell Ranch

Issues related to Waddell Ranch persist with the operator Blackbeard Operating LLC no longer providing monthly information necessary for precise calculation of the Net Profits Interest (NPI). Since May 2024, Blackbeard has limited this information to a quarterly frequency, preventing complete integration of data into the Trust’s monthly distributions.

Argent Trust specifies that no revenue from Waddell Ranch properties was received for the June distribution. Accumulated excess costs must be entirely recovered before resuming payments from this property.

Notable revenue decline in Texas

Meanwhile, Texas Royalty Properties recorded a decline in natural gas production volumes, dropping to 8,278 thousand cubic feet (Mcf) from 9,894 Mcf in the previous month. Despite a slight increase in gas prices to USD 9.48 per Mcf, total revenues were negatively impacted by a decline in oil prices to USD 65.46 per barrel from USD 68.39 the previous month.

In terms of volume, the Trust’s Texas properties produced 14,430 barrels of oil, slightly higher than the 13,619 barrels in the previous month but insufficient to offset the negative effects of overall pricing and volume. After deducting taxes and expenses amounting to USD 139,241, net profits reached USD 1,021,112, thus contributing USD 970,056 to the monthly distribution.

Ongoing judicial dispute

The litigation between the Trust and Blackbeard Operating continues in the District Court of Tarrant County, Texas. Argent Trust claims damages exceeding USD 9 million, alleging Blackbeard miscalculated and deducted certain operating costs between April 2020 and December 2023.

A joint audit of 2024 operations is currently underway. This lawsuit, scheduled to begin on November 17, 2025, promises complexity with significant financial implications for both parties.

This situation leaves open the question of the evolution of future distributions and the financial transparency of the involved operators.