- Partenariats commerciaux

- Focus

ITER and its partner Demathieu Bard have completed the control building of the fusion reactor in Cadarache, marking a key step in the site’s technical management as preparations for future operational phases continue.

The Italian government has approved a bill granting the executive authority to regulate the return of nuclear energy, in line with European carbon neutrality and energy security targets for 2050.

Framatome and the French Alternative Energies and Atomic Energy Commission have commissioned a specialised industrial line in Jeumont for the manufacturing of nuclear components used in French Navy vessels.

Italian company Terra Innovatum is advancing the commercialisation of its SOLO micro-reactor, with two new partnerships and $42.5mn in funding as part of a merger with a listed company.

The Nurlikum Mining joint venture enters a new industrial phase with the launch of the South Djengeldi project, targeting annual production of 500 tonnes of uranium over ten years in Uzbekistan.

The blackout that hit the Iberian Peninsula in April originated from a series of unprecedented surges. The European report points to a sequence of technical failures but does not yet identify a primary cause.

The Senate's economic affairs committee recommends including the reform of the legal framework for dams in the upcoming energy bill to avoid competitive tendering, following a principle agreement between Paris and Brussels.

The French Academy of Sciences calls for a global ban on solar radiation modification, citing major risks to climate stability and the world economy.

Energy producer CVE Biogaz launches a facility in Tarn capable of processing 21,500 tonnes of biowaste per year to produce biomethane injected into the local gas network.

Swedish firm Metacon has secured a EUR7.1mn ($7.7mn) contract to deliver a 7.5 MW electrolysis plant to Elektra Power SRL, marking its operational entry into the Romanian market.

TotalEnergies could bring EDF into the Centre Manche 2 offshore wind project after RWE’s planned withdrawal, strengthening the industrial and financial prospects of the two neighboring parks scheduled for 2032.

The new GeoMap tool identifies vast geothermal potential in the Middle East, notably for urban cooling, long-duration storage, and large-scale power generation.

Envision Energy has signed an agreement to equip Kazakhstan’s largest wind power project, marking a strategic step in energy cooperation with TotalEnergies, Samruk-Energo and KazMunayGas.

Faced with risks to Middle Eastern supply chains, Thai and Japanese refiners are turning to US crude, backed by tariff incentives and strategies aligned with ongoing bilateral trade discussions.

The Japanese company has completed the first phase of a tender for five annual cargoes of liquefied natural gas over seven years starting in April 2027, amid a gradual contractual renewal process.

Neoen has launched construction of its first long-duration battery in Muchea and commissioned the second stage of Collie Battery, bringing its storage capacity in Western Australia to 3,145 MWh.

Queensland coal producers are struggling to rein in costs, which remain above pre-2022 levels as the impact of royalty hikes and margin pressures continues to weigh on the sector.

Australia refocuses its national biomass plan on agriculture and forestry, excluding green hydrogen and urban waste from eligible feedstocks.

Energy Fuels has completed a $700mn fundraising through 0.75% convertible notes, aimed at supporting its rare earth and uranium projects.

The Canadian government is investing nearly CAD17mn ($12.4mn) to support two hydroelectric initiatives led by Indigenous communities in Quebec, aiming to reduce diesel dependency in remote regions.

- Last news

After being intercepted by the French navy, the Boracay oil tanker, linked to Russia's shadow fleet, left Saint-Nazaire with its oil cargo, reigniting tensions over Moscow’s circumvention of European sanctions.

Russian seaborne crude shipments surged in September to their highest level since April 2024, despite G7 sanctions and repeated drone strikes on refinery infrastructure.

Russia’s Energy Ministry stated it is not considering blocking diesel exports from producers, despite increasing pressure on domestic fuel supply.

Facing a potential federal government shutdown, multiple US energy agencies are preparing to suspend services and furlough thousands of employees.

A report reveals the economic impact of renewable energy losses in Chile, indicating that a 1% drop in curtailments could generate $15mn in annual savings.

EDF power solutions and El Paso Electric have started operations at the Milagro Energy Center, combining 150 MW of solar photovoltaic capacity and 75 MW of battery storage under a 20-year power purchase agreement.

Uranium deliveries to U.S. civilian operators rose 8% in 2024, while the average price climbed to its highest level since 2012, according to the latest available data.

Coal will temporarily become the main source of electricity in the Midwest markets MISO and SPP during winter, according to the latest federal forecasts.

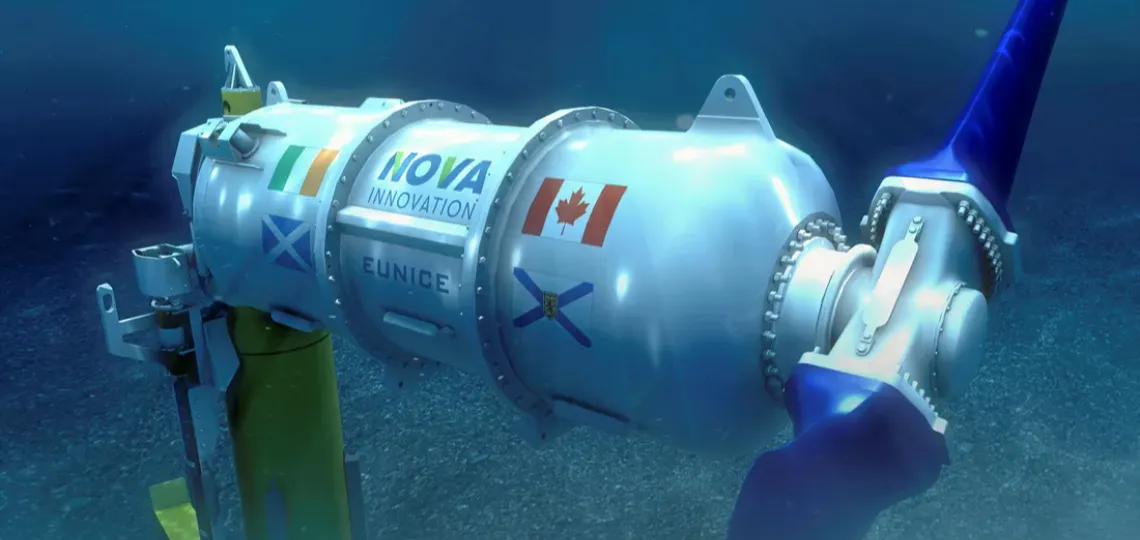

The 600MW submarine interconnection between Tunisia and Italy enters its construction phase, marking a logistical and financial milestone for the Euro-Mediterranean electricity market.

The Dunkirk LNG terminal, the second largest in continental Europe, is seeing reduced capacity due to a nationwide strike disrupting all French LNG infrastructure.

TotalEnergies has reached a deal to sell mature offshore oil fields in the North Sea to Vår Energi as part of a $3.5bn divestment plan aimed at easing its rising debt.

Iberdrola strengthens its partnership with Norges Bank Investment Management by adding two Spanish photovoltaic plants, raising joint operational capacity to 900 MW.

Statkraft continues its strategic shift by selling its district heating unit to Patrizia SE and Nordic Infrastructure AG for NOK3.6bn ($331mn). The deal will free up capital for hydropower, wind, solar and battery investments.

The Swedish energy group aims to produce 9TWh per year with its Storlandet project, intended to meet rising demand from the mining and steel industries in the north of the country.

The Russian government has extended the ban on gasoline and diesel exports, including fuels traded on the exchange, to preserve domestic market stability through the end of next year.

OPEC has formally rejected media reports suggesting that eight OPEC+ countries plan a coordinated oil production increase ahead of their scheduled meeting on October 5.

Ukrenergo plans to raise electricity transmission tariffs by 20% in 2026 to cover technical costs and obligations tied to international loans.

The Vice-Chairman of Russia’s Security Council believes more countries will develop nuclear weapons and generative AI technologies as a result of increasing public sector efforts.

Russia’s liquefied natural gas output will increase steadily through 2027 under the national energy development plan, despite a 6% drop recorded in the first eight months of 2024.

QatarEnergy has signed a long-term contract with Messer to supply 100 million cubic feet of helium per year, strengthening Doha’s position as a key player in this strategic market.