The U.S. decision to temporarily suspend licenses allowing companies to sell critical components for nuclear power plants to China comes as economic relations between the two powers remain highly strained. This measure, imposed by the U.S. Department of Commerce, directly impacts major industrial players involved in global energy supply chains.

License suspension and impacted sectors

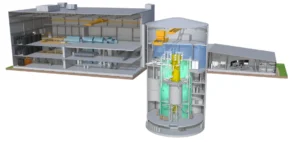

Among the companies affected are Westinghouse Electric Company, specializing in nuclear technologies, and Emerson Electric Co., a supplier of advanced control systems for power plants. The suspended licenses cover contracts potentially worth hundreds of millions of dollars. This blockage occurs amid existing restrictions on other crucial technological sectors, such as aerospace and semiconductor industries. Companies like General Electric (GE), Cadence Design Systems, and other strategic American firms are also seeing their operations disrupted.

These suspensions coincide with renewed tensions over exports of ethane and butane, essential raw materials for Chinese chemical and petrochemical industries. Computer-aided design software used in chip manufacturing is also included in the list of recent restrictions imposed by U.S. authorities. Washington justifies these measures by citing the necessity of protecting technologies considered sensitive for its economic and strategic security.

China’s reaction and consequences

For its part, China has strongly reacted, accusing the United States of abusing export controls and hinting at potential retaliation, notably targeting rare metals and other critical resources essential to American technological industries. Chinese authorities assert that these U.S. restrictions aim to limit their access to technologies vital for national economic growth. This situation could prompt Beijing to accelerate its technological development in an effort to quickly reduce its dependence on foreign suppliers.

Chinese industrial stakeholders directly affected are now seeking alternatives to sustain operations and fulfill their commitments to the domestic market. Negotiations between U.S. and Chinese authorities remain ongoing, although there is no certainty regarding the duration of the current restrictions. Bilateral diplomatic dialogue continues in the background, but no significant progress has been reported since the latest exchange between U.S. President Donald Trump and his Chinese counterpart Xi Jinping.