Russia has officially initiated proceedings with the World Trade Organization (WTO) against the European Union (EU) to challenge its Carbon Border Adjustment Mechanism, commonly known as CBAM. This mechanism imposes additional charges on carbon-intensive imports, such as steel, aluminum, and fertilizers. Moscow denounces the policy as disguised economic protectionism and argues it introduces unjustified discrimination against Russian exporters. The initiated procedure could set a precedent influencing future international trade regulations related to carbon emissions.

The European mechanism targeted by Moscow

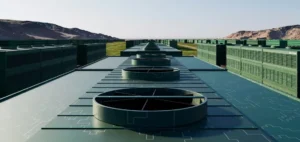

The CBAM, introduced by the EU, aims to reduce global CO₂ emissions by imposing costs on imports from countries with less stringent climate regulations. According to Russia, this mechanism violates fundamental principles of international trade established by the WTO, notably non-discrimination and national treatment. Russian authorities have also criticized the free allocation of quotas under the European Union Emissions Trading System (EU ETS), asserting that these allocations constitute prohibited export subsidies under international trade rules. Russian industrial sectors most impacted include producers of steel, fertilizers, and aluminum, which rely heavily on access to the European market.

Crucial consultations for trade future

The complaint filed at the WTO triggers a mandatory consultation phase lasting up to 60 days, during which the EU and Russia must attempt to reach common ground. If no agreement is reached at the end of these discussions, Russia may request the formation of a special arbitration panel within the WTO. This judicial procedure could then extend over several years before a final decision is made. A possible Russian victory could call into question not only the CBAM but also influence future international regulations on carbon taxation.

Potential repercussions on energy markets

The consequences of this trade dispute could extend beyond mere regulatory frameworks, directly affecting global carbon markets. If CBAM is invalidated by a WTO ruling, other commodity-exporting countries with high carbon intensity may be encouraged to challenge similar regulations elsewhere in the world. Conversely, if the European mechanism is upheld, it could potentially reinforce the adoption of border carbon taxes in other regions, intensifying pressure on industries reliant on fossil fuels and high carbon emissions.