Saudi Arabia is seeking to develop new outlets for its mineral resources in Europe, particularly in France, to support the growth of its industrial sector. The Minister of Industry and Mineral Resources, Bandar Al Khorayef, presented titanium and aluminium produced in the kingdom as strategic materials that could supply the European aerospace sector.

A response to supply chain pressure

A Saudi-Japanese joint venture, active since 2015 in Saudi Arabia, produces up to 15,000 tonnes per year of “titanium sponge”, a material used in aerospace manufacturing. The minister stated that this capacity could be increased, in a context where Airbus and Safran are working to reduce their dependence on Russia. He conducted a three-day visit to France, which included meetings with Airbus subcontractors in Toulouse, Airbus Helicopters in Marignane, as well as with the management of engine manufacturer Safran.

Titanium is a lightweight, corrosion-resistant metal widely used in aircraft structures. While international sanctions have not yet targeted Russian titanium, European companies are anticipating supply risks. An industry expert interviewed by AFP described the discussions as “strategic” for diversifying sourcing, while noting that current Saudi production is not sufficient to meet Airbus’s needs.

Alternative materials and expected approval

The kingdom is also seeking to have its aluminium certified according to Airbus standards, for use in aircraft fuselages. In parallel, Saudi Arabia aims to develop the exploitation and transformation of its resources in minerals, industrial plastics, and composites derived from its petrochemical industry.

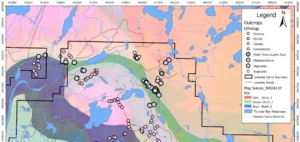

Identified resources include bauxite, phosphate, copper, zinc, gold, silver, and a reportedly significant quantity of rare earth elements. Since 2018, a geological exploration programme has doubled the estimated mineral reserves of the country, from $1,300bn to $2,500bn, according to figures provided by the minister.

Bilateral talks on rare metals

Bandar Al Khorayef stated that the Council of Ministers had given him approval to initiate direct negotiations with the French government on an agreement related to rare metals. On this occasion, he met with Benjamin Gallezot, France’s interministerial delegate for strategic minerals and metals supply.

The minister also held discussions with Orano, a French nuclear fuel supplier, to evaluate uranium extraction techniques from phosphate. This move aligns with a strategy announced in January by Saudi Energy Minister Abdulaziz bin Salman, under which the kingdom plans to enrich and commercialise uranium.

Industrial platform and trade climate

Against a backdrop of the war in Ukraine and ongoing trade tensions with the United States, the minister believes the kingdom could become an attractive industrial platform. He mentioned the possibility for companies from countries under stricter sanctions to establish operations in Saudi Arabia for export to the North American market. This approach would involve joint ventures with Saudi investors under a regulatory framework considered more stable.