Eni begins the transformation of its Priolo complex in Sicily with a 500,000-tonne biorefinery and a chemical plastic recycling plant, based on its proprietary Hoop® technology.

Norwegian-based Kyoto has launched a 56 MWh thermal storage system at KALL Ingredients in Hungary, designed to replace natural gas with renewable-based industrial heat.

An international audit led by the International Atomic Energy Agency confirms that Spain has fully addressed the recommendations made in 2018 regarding its nuclear waste management programme.

The European Bank for Reconstruction and Development is reviewing a loan for a 100 MW photovoltaic project led by Qair in Tunisia, backed by a long-term power purchase agreement with the national utility.

An agreement was reached between Khartoum and Juba to protect key oil installations, as ongoing armed conflict continues to threaten crude flows vital to both economies.

Alnaft has signed two study agreements with Omani firm Petrogas E&P on the Touggourt and Berkine basins, aiming to update hydrocarbon potential in key oil-producing areas.

Gauss Fusion has released a full-scale plan for GIGA, its first commercial fusion power plant, amid Germany’s growing ambition to lead the future energy race.

Ferrari unveiled the chassis of its first electric vehicle, the Elettrica, while announcing a revision of its electrification targets, favouring thermal and hybrid powertrains for the coming decade.

Serbian oil company NIS, partially owned by Gazprom, faces newly enforced US sanctions after a nine-month reprieve, testing the country's fuel supply chain.

Global demand for biofuels is driving a sharp increase in used oil imports to Europe and the United States, straining global feedstock supply chains, according to the International Energy Agency.

ABB made several attempts to acquire Legrand, but the French government opposed the deal, citing strategic concerns linked to data centres.

The price of nature-based carbon credits dropped to $13.30/mtCO2e in October as a 94% surge in September issuances far outpaced corporate demand.

Wpd launches a crowdfunding campaign to support the construction of the Bréhand wind farm, aiming to raise €400,000 from residents with a fixed annual interest rate of 7%.

A parliamentary report questions the 2026 electricity pricing reform, warning of increased market exposure for households and a redistribution mechanism lacking clarity.

US-based Chevron appoints Kevin McLachlan, a veteran of TotalEnergies, as its global head of exploration, in a strategic move targeting Nigeria, Angola and Namibia.

Nuclear Power Corporation of India Ltd has pushed the Bharat Small Reactors proposal deadline to 31 March 2026, aiming to expand private sector engagement in the captive nuclear energy project.

The Philippine government grants contractual advantages and priority dispatch to its first nuclear project, laying the groundwork for sustained sector development in the coming decades.

Aramco becomes Petro Rabigh's majority shareholder after purchasing a 22.5% stake from Sumitomo, consolidating its downstream strategy and supporting the industrial transformation of the Saudi petrochemical complex.

Singapore’s gasoil and kerosene inventories reached a three-month high after a sharp weekly drop in net exports, supported by a marked increase in imports from Northeast Asia.

Chevron India expands its capabilities with a 312,000 sq. ft. engineering centre in Bengaluru, designed to support its global operations through artificial intelligence and local technical expertise.

- Last news

Ambassadors of European Union member states have approved the transmission of a legislative proposal to phase out Russian fossil fuel imports by January 2028 to the Council of Ministers.

The State Duma has approved Russia’s formal withdrawal from a treaty signed with the United States on the elimination of military-grade plutonium, ending over two decades of strategic nuclear cooperation.

Amid rising energy costs and a surge in cheap imports, Ineos announces a 20% workforce reduction at its Hull acetyls site and urges urgent action against foreign competition.

Driven by the energy, heavy industry and power generation sectors, the global carbon capture and storage market could reach $6.6bn by 2034, supported by an annual growth rate of 5.8%.

Article 6 converts carbon credits into a compliance asset, driven by sovereign purchases, domestic markets, and sectoral schemes, with annual demand projected above 700 Mt and supply constrained by timelines, levies, and CA requirements.

Global demand for industrial gases will grow on the back of hydrogen expansion, carbon capture technologies, and advanced use in healthcare, electronics, and low-carbon fuel manufacturing.

Fuel shortages now affect Bamako, struck in turn by a jihadist blockade targeting petroleum flows from Ivorian and Senegalese ports, severely disrupting national logistics.

The Seine-Maritime prefecture denies Aquind access to public maritime domain, halting a €1.4bn ($1.47bn) Franco-British power interconnection project.

McDermott has signed a memorandum of understanding with PETROFUND to launch technical training programmes aimed at strengthening local skills in Namibia’s oil and gas sector.

Driven by growing demand for strategic metals, mining mergers and acquisitions in Africa are accelerating, consolidating local players while exposing them to a more complex legal and regulatory environment.

The example of OML 17 highlights the success of an African-led oil production model based on local accountability, strengthening Nigeria’s position in public energy investment.

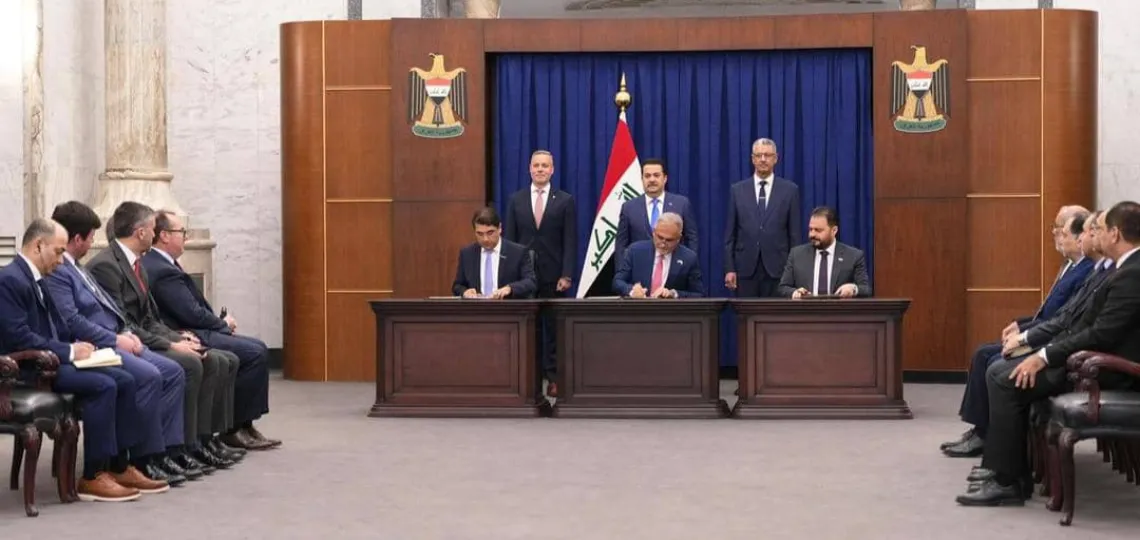

ExxonMobil has signed a memorandum of understanding with the Iraqi government to develop the Majnoon oil field, marking its return to the country after a two-year absence.

H.E Energy will develop 100 low-voltage solar facilities totalling 10MWDC in Hokkaido for SMFL Mirai Partners, with commissioning scheduled by June 2026.

Hokkaido Gas has launched a 2MW solar power plant in Kamishihoro, with an expected annual output of 4.4GWh to be distributed locally through energy supplier Karch.

Indonesian authorities identified traces of caesium-137 in 22 facilities near Jakarta following the recall of contaminated shrimp exported to the United States by a local producer.

Hanoi is preparing a tax relief plan for biofuel producers to support domestic ethanol output ahead of the E10 mandate rollout planned for 2026.

Sembcorp Industries has signed a purchase agreement to acquire a 300-megawatt solar plant in India, boosting its renewable energy footprint to a total capacity of 6.9 gigawatts.

Crude prices rose following the decision by the Organization of the Petroleum Exporting Countries and its allies to increase production only marginally in November, despite ongoing signs of oversupply.

Cenovus Energy modifies terms of its acquisition of MEG Energy by increasing the offer value and adjusting the cash-share split, while reporting record third-quarter results.

The US Senate has confirmed two new commissioners to the Federal Energy Regulatory Commission, creating a Republican majority that could reshape the regulatory approach to national energy infrastructure.