Ørsted announces the signing of an agreement with Equinor for the sale of 330,000 tonnes of carbon dioxide removal (CDR) credits over a ten-year period.

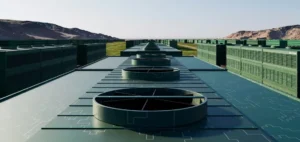

The partnership is based on the development of the Ørsted Kalundborg CO2 Hub, a major project aimed at capturing 430,000 tonnes of biogenic CO2 per year from 2026.

This carbon will come from two biomass-fired cogeneration plants owned by Ørsted.

The aim is to capture the CO2 emitted by sustainable biomass sources.

This CO2 will then be transported for permanent storage beneath the floor of the North Sea. This storage process removes carbon from the atmosphere and contributes to decarbonization efforts.

Underground storage will be provided by Northern Lights, an infrastructure owned in part by Equinor.

Economic challenges and solutions for the CDR credit market

Biomass-based carbon capture and storage (CCS) is a technology still in the development phase, with high costs associated with it.

The market for carbon removal credits is still in its infancy, and the economic viability of projects such as Kalundborg depends heavily on the sale of these credits.

Ørsted also benefits from financial support from the Danish Energy Agency, which is crucial if these technologies are to reach the necessary maturity.

This agreement between Ørsted and Equinor illustrates the strategy adopted by companies to position themselves on the voluntary carbon market.

Equinor, in its drive to reduce Scope 1 and 2 greenhouse gas emissions, is aiming for a 50% reduction by 2030 compared with 2015 levels.

Although the majority of this reduction (90%) is to be achieved through direct measures, up to 10% of this target can be achieved through CO2 removal credits, such as those provided by Ørsted.

An agreement at the heart of decarbonization

For Equinor, this partnership enables us to meet part of our emissions reduction targets, while helping to structure a promising but as yet unregulated market.

Carbon credits, although still marginal, offer companies an alternative for offsetting certain incompressible emissions.

This approach enables Equinor to combine direct decarbonization efforts with offsetting solutions via the CDR market.

For Ørsted, the agreement is seen as a strategic step forward for its carbon capture project, which relies on technologies that are still emerging.

The aim is to consolidate these technologies into a viable business model, based on industrial partnerships such as this one.

Economic and regulatory outlook

While this agreement shows the way forward, the CDR market is still subject to a number of uncertainties, particularly in terms of regulation.

Current standards for carbon offsets vary from country to country and region to region.

Discussions are underway at international level to further regulate these practices and establish more solid legal frameworks for carbon credit trading.

For companies like Ørsted and Equinor, these legislative advances will be decisive for the sustainability of their projects and the structuring of a more fluid market.

The involvement of public institutions, such as the Danish Energy Agency, is also seen as a stabilizing factor in attracting new players to this booming sector.

This agreement is an illustration of the efforts made by major industrial players to anticipate future regulations while integrating the latest technological innovations into their strategies.

Ørsted, in particular, is establishing itself as a key player in the development of solutions integrating carbon capture technologies and their monetization via CDR credits.