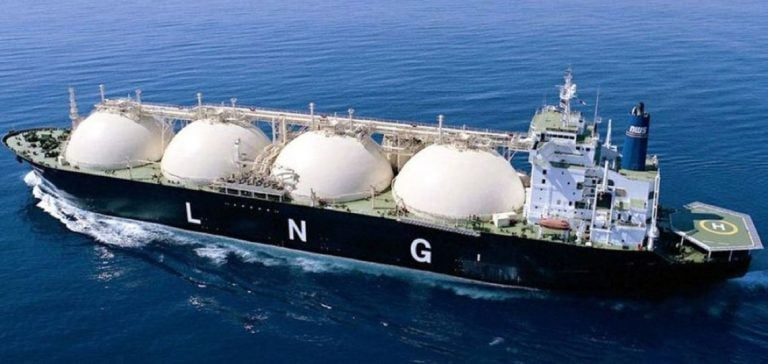

Kimmeridge Texas Gas and Commonwealth LNG announce a strategic agreement with Glencore LTD, marking a significant step forward in the natural gas and LNG sector.

Against a backdrop of global energy transition, the agreement aims to establish a lasting collaboration between these key players, strengthening their position in the international market.

Under the terms of the agreement, Glencore will purchase 2 million tonnes per year of LNG from Commonwealth for 20 years, while securing an equivalent supply of natural gas from KTG, based on a netback agreement at international prices.

The agreement, which is expected to be finalized in the fourth quarter of 2024, is part of Commonwealth’s ambitions to make a final investment decision for its Louisiana LNG export facility in the first half of 2025.

LNG production is scheduled to begin in 2028, marking a crucial milestone for all three companies involved.

This partnership illustrates KTG’s commitment to becoming an integrated supplier of natural gas, from well to water, while meeting the market’s growing demands for energy security and sustainability.

A strategic partnership for the future of LNG

David Lawler, CEO of KTG, emphasizes the importance of this collaboration: “Our partnership with Glencore represents a tangible step towards our goal of becoming an integrated supplier of reliable, secure and clean energy.”

This statement highlights KTG’s commitment to meeting the world’s energy needs while adhering to sustainability standards.

By partnering with Commonwealth, KTG aims to reach critical international markets, strengthening its presence on the world stage.

Maxim Kolupaev, Global Head of LNG, Gas and Energy at Glencore, added: “We are delighted to partner with Kimmeridge Texas Gas and Commonwealth, two leading companies in the natural gas sector.”

This collaboration builds on Glencore’s LNG marketing platform, which facilitates access to international pricing, while supporting economies’ energy transition ambitions.

This strategic partnership builds on a strong relationship between Glencore and Kimmeridge, founded on a shared vision of responsible LNG production and use.

Implications for the LNG market

The agreement between KTG, Commonwealth and Glencore could have a significant impact on the global LNG market.

By guaranteeing long-term supply, the companies involved strengthen their position in the face of price volatility and growing demand for LNG.

This type of agreement is essential for stabilizing the market and attracting investment in critical infrastructure, particularly in the context of the energy transition.

Moreover, Commonwealth’s commitment to developing an LNG export facility in Louisiana testifies to its confidence in the growth potential of the North American market.

The final investment decision scheduled for 2025 could also encourage other players to consider similar projects, thus contributing to the expansion of LNG infrastructure in the USA.

It could also strengthen the position of the USA as a key supplier to the global LNG market.

Future prospects

As the world moves towards more sustainable energy solutions, the role of LNG in the energy transition is becoming increasingly crucial.

Companies like KTG and Commonwealth, by partnering with major players like Glencore, are leading the way in meeting today’s energy challenges.

The focus on responsible production and secure supply could also influence energy policies worldwide, encouraging wider adoption of LNG as an alternative to more polluting fossil fuels.

The implications of this agreement go beyond mere commercial transactions.

They underline the need for industry players to work together to navigate an ever-changing energy landscape.

By integrating sustainable practices and responding to market demands, KTG, Commonwealth and Glencore are positioning themselves as leaders in the transformation of the energy sector, while contributing to the decarbonization of economies.