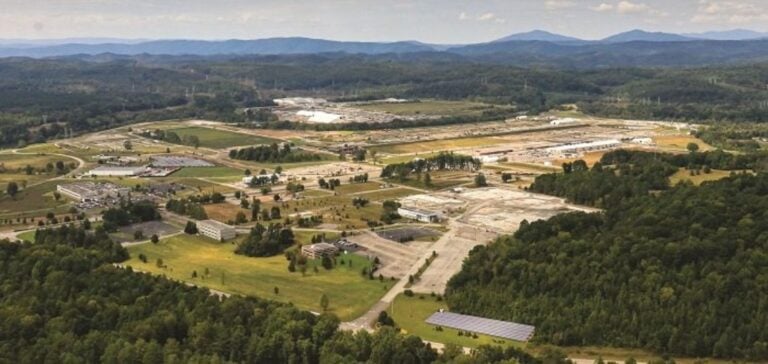

Orano, a French public company specializing in the nuclear fuel cycle, has selected Oak Ridge, Tennessee, as the site for a new uranium enrichment plant.

This project is part of a strategy to reduce the United States’ dependence on uranium enriched by Russia, which currently dominates the market with around 43% of global capacity.

The development of this new facility responds to a growing demand for alternative sources of supply, stimulated by geopolitical concerns and regulatory constraints.

The project, which represents a multi-billion dollar investment, will benefit from financial and regulatory support from the US authorities.

Jean-Luc Palayer, CEO of Orano USA, explains that the next steps include securing federal support, customer commitment, as well as licensing by the Nuclear Regulatory Commission (NRC) and approval by Orano’s Board of Directors.

The plant is expected to create over 300 jobs, and is supported by funding from the State of Tennessee through the $60 million Nuclear Energy Fund.

Strengthening US Nuclear Independence

Orano’s decision to expand in the United States comes against a backdrop of tightening energy security policies.

Recent US legislation, signed by President Joe Biden, aims to end dependence on Russian enriched uranium.

The legislation includes a ban on the import of enriched uranium from Russia, and provides up to $2.7 billion in funding to support the development of domestic uranium projects.

By securing a source of enriched uranium from domestic sites, the United States seeks to reduce the risks associated with a potential interruption in Russian supplies, particularly in the event of escalating geopolitical tensions.

Orano, for its part, is seeking to diversify its capacities and adapt to the new realities of the global nuclear market.

The company, which also operates enrichment sites in France, plans to increase its capacity to meet increased demand from its American customers, while minimizing the risks associated with possible disruptions to supplies from Rosatom, the Russian supplier.

Project Challenges and Opportunities in Tennessee

The establishment of the plant in Oak Ridge represents a significant step forward for the nuclear sector in the United States, offering not only an alternative to Russian supplies, but also strengthening the local industrial infrastructure.

This project joins the efforts of other players in the sector, such as Centrus Energy, which recently launched a facility in Ohio for the production of HALEU (High-Assay Low-Enriched Uranium), an essential fuel for new-generation reactors.

Challenges associated with this project include the need to secure financing and approvals, as well as navigating the complex nuclear regulatory landscape in the USA.

The uranium enrichment market remains competitive, with companies such as Urenco and Global Laser Enrichment, LLC, also looking to capitalize on growing demand for domestic supply solutions.

Long-Term Outlook for the US Nuclear Sector

With the construction of this new facility, Orano is strengthening its position in the US market while contributing to a global strategy of energy security.

As the US nuclear industry evolves, the emergence of alternative suppliers of enriched uranium could reduce Russia’s market share, while fostering a more resilient and diversified ecosystem.

However, the project’s success will depend on a number of factors, including stakeholder commitment, local acceptability, and the industry’s adaptability to technological and regulatory changes.

Orano’s involvement in this project demonstrates the company’s commitment to becoming a sustainable part of the U.S. energy supply chain, while supporting the transition to greater energy self-sufficiency.

The growing demand for stable and secure energy sources will continue to shape the landscape of the global nuclear market, and companies that can anticipate these dynamics will have a strategic advantage in the decades to come.