Under the Vosges countryside, pipes to the rescue of Europe: near Vittel, the Morelmaison compressor station sucks in gas from Norway, Qatar or the United States and pushes it to Europe, and in particular Germany, as a winter without Russian gas begins.

In the heart of a bucolic landscape, this industrial site carries out a discreet but essential mission to bring gas to Europe, in particular to Germany, which was 55% dependent on Russia before the war in Ukraine.

On the surface, there are valves and pipes but little spectacular activity on this remotely controlled site, where only four people work.

The Morelmaison station is no less strategic: it ensures the interconnection between a gas pipeline that brings gas, especially Norwegian, from Dunkirk in the north, another in the direction of Switzerland, a pipeline that historically brought Russian gas from Germany to the south of France from the northeast.

There are 26 gas compression stations like the one in Morelmaison spread across France on the 32,527 km pipeline network managed by the French gas transmission operator GRTgaz.

They interconnect the arteries that arrive and leave the station by a set of valves, but also, thanks to turbines, to raise the gas pressure to compensate for the losses caused during transport. “Raising the pressure allows us to push the gas into the pipes,” Guillaume Steschenko, deputy head of the compression department at GRTgaz, summarized to AFP.

“The gas flows that pass through the station supply Germany, Switzerland and Belgium, and therefore make it possible (…) to show solidarity in a very concrete way and to compensate for the drop in flows from Russia,” emphasizes Guillaume Tuffigo, head of the marketing division at GRTgaz.

Gas inlet door

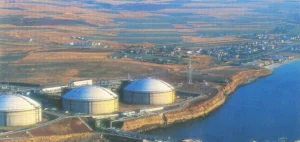

With Russian gas drying up in the pipes, Europe has had to diversify its supplies, using Norwegian natural gas and liquefied natural gas from Qatar and the United States, which arrives by ship at four French LNG terminals operating at full capacity.

Long seen by gas companies as the “dead end” for Russian gas, France has paradoxically become one of the entry points for gas into Europe since gas from Moscow has stopped flowing, or almost stopped flowing.

An idea “still unthinkable two years ago”, admits Thierry Trouvé, General Manager of GRTgaz. “We didn’t see too much reason to think that this east-west flow could be challenged,” he adds.

In the gas business, wasn’t it said that “Russian gas kept coming throughout the Cold War”?

Historically, gas arrived in France via Germany and Belgium to be consumed in the country or redirected to Spain and Switzerland.

But since the war, the gas highways and the direction of the pipes are reversed. In concrete terms, France receives gas from Spain and “from now on, the flows will go from France to Belgium and Germany,” explains Guillaume Tuffigo.

France, via the GRTgaz network, has increased gas transport to Switzerland sevenfold in 2022 compared to 2021. At the same time, GRTgaz received 70% less gas from Germany in 2022 compared to 2021 (52 terawatt-hours in 2021 and only 14 TWh in 2022).

As a symbol of this historic reversal, France has been sending gas directly to its German neighbor since October 13, under a mutual aid agreement between the two countries.

As of November 22, 2.7 TWh of gas, the equivalent of what three nuclear reactors would supply, have been sent to Germany via the Obergailbach gas border station (Moselle), a site that is closed to visitors and is itself connected to Morelmaison.

France provides a transmission capacity of 100 GWh/day, the maximum technically possible at this stage.

For the time being, Europe, whose stocks are full (93% on Wednesday), is doing without Russian gas pipelines, but for how long? “Until we have new liquefied gas production capacity, it’s going to be tricky for another five years,” Trouvé predicts.