Venezuela is plunged into a political crisis following the presidential elections held on July 28.

The opposition, led by Edmundo González, claimed victory with 69.5% of the vote, against the 51.2% announced for Nicolás Maduro by the National Electoral Council (CNE).

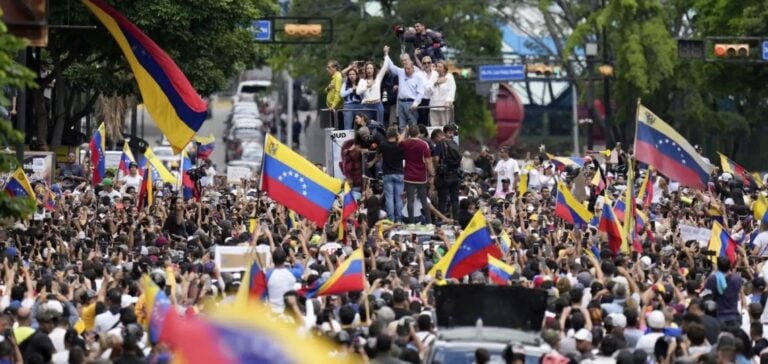

This discrepancy triggered demonstrations across the country.

Despite the political tension, Venezuela’s oil and gas industry continues to operate normally.

Venezuela holds the world’s largest proven oil reserves, at 303 billion barrels, and natural gas reserves of 200 trillion cubic feet.

Maria Corina Machado, an opposition figure, said that the official election results did not reflect the popular will and that evidence of González’s victory would be published online.

Implications for the Energy Industry

Venezuela’s political stability is crucial to its energy sector.

Production and refining activities continue, but foreign companies such as Chevron remain vigilant. The United States, through the Biden administration, has called for the immediate publication of detailed polling station results to verify the outcome of the elections.

Despite doubts about the legitimacy of Maduro’s victory, the specific licenses granted to companies like Chevron to operate in Venezuela have not been called into question for the time being.

Challenges and Opportunities for Energy Investment

The current political uncertainty poses challenges for investment in the Venezuelan energy sector.

Modernizing infrastructure and increasing production require considerable capital.

A peaceful political transition could offer opportunities to restructure and improve the energy industry, thus attracting new investors.

However, persistent unrest could discourage potential investors and complicate the realization of long-term projects.

Investor confidence will depend on Venezuela’s ability to guarantee lasting political and economic stability.

Venezuela’s energy sector is at a crossroads.

The post-election crisis and competing claims to victory between González and Maduro are creating an atmosphere of uncertainty.

The energy sector remains crucial to the country’s economy and to the global market.

The resolution of this crisis will determine Venezuela’s future as a major energy producer.