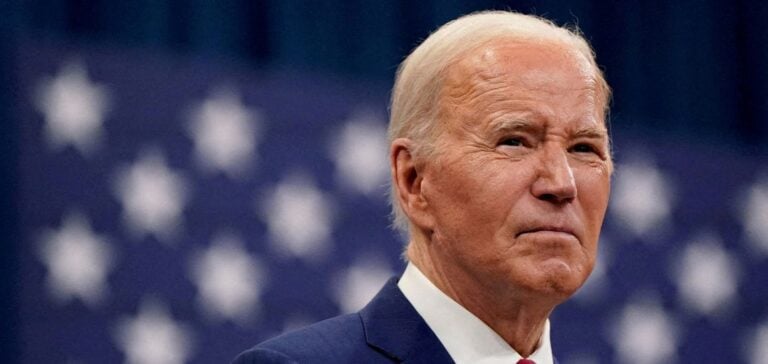

Voluntary carbon market participants welcome US President Joe Biden’s initiative to publish a set of principles designed to restore confidence in carbon credits and strengthen the role of offsets in decarbonization. Mark Kenber, Executive Director of the Voluntary Carbon Markets Integrity Initiative, says this clear direction from governments gives companies the confidence to act. Allister Furey, CEO and co-founder of Sylvera, points out that more governments and institutions should recognize the power of high-integrity markets. However, persistent integrity problems continue to hamper this potential.

“U.S. government support for immediate reforms should complement the initiatives, standards and tools that have emerged in recent years to strengthen market integrity and provide positive reinforcement for ongoing efforts.”

Market operation and support

The US government encourages the US private sector and other stakeholders to participate responsibly in the VCM (Voluntary Carbon Market), in line with its principles. The Biden administration’s approval is seen as legitimizing a well-functioning carbon market, linking a high-integrity supply of credits with high-integrity demand from credible buyers. US Treasury Secretary Janet Yellen says voluntary carbon markets can help unleash the power of private markets to reduce emissions, provided existing challenges are addressed. These principles recognize the need to ensure the integrity of credits, including protections for climate and environmental justice, the credible use of credits and the integrity of the global market.

“Voluntary carbon markets can help unleash the power of private markets to reduce emissions, but this can only happen if we address the significant challenges that exist. These principles recognize the need for: integrity of credits, including protections for climate and environmental justice (supply-side integrity); credible use of credits (demand-side integrity); and integrity at the market level, including facilitating efficient market participation and reducing transaction costs. These principles are not exhaustive, and they aim to elevate concepts already developed by civil society, international organizations, governments and multilateral forums.”

Impact of reviews

Criticism of the quality of certain carbon projects has had a major impact on offset prices, deterring some companies from participating in the market. Loan prices have fallen sharply over the past 12 months due to reduced liquidity. Platts, a division of S&P Global Commodity Insights, values current-year nature-based carbon credits at $3.45/tCO2e as of May 27, up slightly from a record low of $2.70/tCO2e seen in February.

Integrity initiatives

A series of integrity initiatives are currently being adopted by the VCM, led by the VCMI on the demand side and the Integrity Council for the Voluntary Carbon Market on the supply side with its Core Carbon Principles. These initiatives aim to enhance the transparency and reliability of voluntary carbon markets by improving quality standards and reducing transaction costs.

Future prospects and developments

The US government’s support for immediate reforms should complement the initiatives, standards and tools that have emerged to improve market integrity in recent years, and provide positive reinforcement for ongoing efforts. The participants hope that this intervention will help overcome the current challenges and boost the market, by attracting more companies to invest in carbon credits.

Joe Biden’s initiative to strengthen the integrity of the voluntary carbon market marks an important step towards better regulation and greater investor confidence. As standards and principles develop, the market will be able to play a crucial role in global decarbonization, offering reliable mechanisms for reducing emissions and supporting climate justice.