On March 28, the US Department of Energy (DOE) announced a $62 million investment in battery recycling in the USA. It is designed to meet the growing demand for battery recycling, as electric vehicles continue to increase their share of vehicle sales. The decision comes just days after China lodged a complaint with the WTO about US subsidies for electric vehicles. This investment in battery recycling, reprocessing and collection is an “essential part” of the Biden administration’s $1 trillion infrastructure legislation, the statement said. The Infrastructure Act has earmarked $7 billion for the domestic battery supply chain.

An integral supply chain strategy

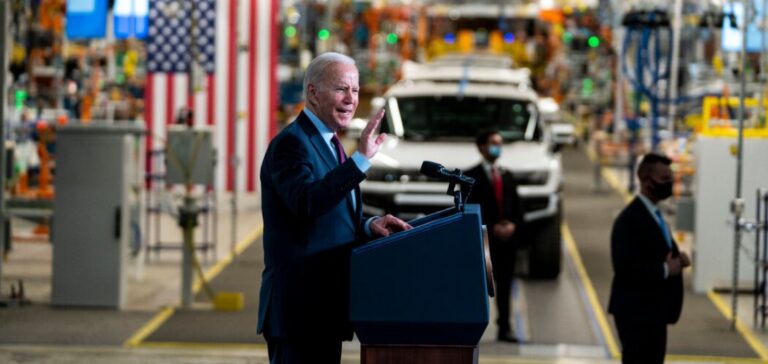

“Capturing the entire battery supply chain – from sourcing critical materials to manufacturing and recycling – puts the U.S. at the forefront as we build our clean energy economy,” said Jennifer Granholm, U.S. Secretary of Energy, in a DOE statement on March 28. “With the historic support of President Biden’s Investing in America agenda, we’re creating a circular, sustainable supply chain that reduces costs for consumers and strengthens our global competitive advantage in manufacturing.”

Funded projects and education

The 17 projects announced for funding include: $40.1 million for seven projects working to improve market demand for consumer battery recycling via approaches including artificial intelligence and automatic sorting; $14.4 million for four projects in student education and awareness-raising, such as e-waste collection events, to broaden participation in consumer electronics recycling; $7.2 million for six projects establishing battery collection programs, including drop-off and storage facilities.

Under the Biden administration, EV sales “quadrupled”, according to the DOE statement. “With demand for electric vehicles and stationary energy storage projected to expand the lithium battery market up to tenfold by 2030, investments in sustainable, lower-cost recycling of consumer batteries are critical to securing the domestic materials supply chain to meet this demand,” reads the statement.