On Tuesday, oil and gas major TotalEnergies announced the acquisition of a 40% stake in an exploration permit for CO2 storage in Norway.

TotalEnergies acquires a major stake in Norway’s ‘Luna’ project with CapeOmega Carbon Storage

TotalEnergies has signed an agreement with CapeOmega Carbon Storage, a 100% subsidiary of the Norwegian group CapeOmega, to acquire the latter’s 40% interest in the ExL004 exploration permit for CO2 storage (“Luna” project).

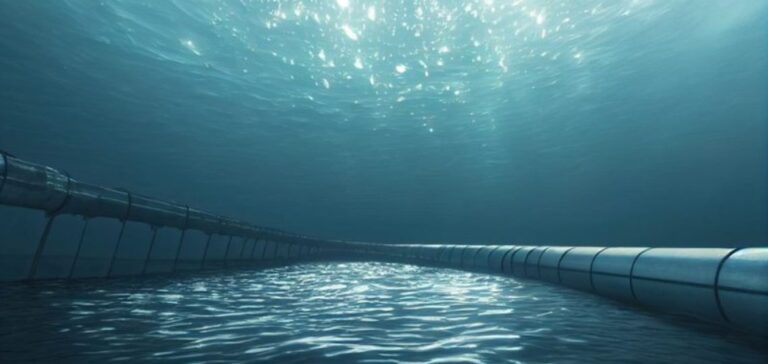

“Located 120 kilometers offshore Bergen (a city in western Norway) at a water depth of 200 meters, the ExL004 permit covers an area of 453 km2”, says the Group.

It adjoins the permit for another CO2 storage site under development, the “Northern Lights” project, owned equally by TotalEnergies, Equinor and Shell, whose first phase is due to start up in 2024. Norway’s Wintershall DEA Norge, with a 60% interest, operates ExL004, as TotalEnergies explains.

“This transaction is an important step for the growth of our CO2 storage business: subject to positive exploration, this permit could enable the storage of several hundred million tonnes of CO2, from the industrial sectors that are the most difficult to decarbonize in Europe,” according to Arnaud Le Foll, the group’s New Business – Carbon Neutrality Director, quoted in the press release.

TotalEnergies at the forefront of CO2 storage projects in the North Sea and other key regions

TotalEnergies is currently developing several other CO2 storage projects in the North Sea, the Netherlands, Denmark and the UK. Still in its infancy and very costly, carbon capture and storage (CCS) involves capturing and then trapping CO2, the main cause of global warming.

After capture and transport, the CO2 is injected and stored underground. IFPEN Energies nouvelles, a public-private research organization, has identified deep saline aquifers as suitable geological structures for massive CO2 storage, due to their capacity at great depths and their non-potability.