The GECF (Gas Exporting Countries Forum) warns about artificial interventions in the gas market. They argue that such interventions would exacerbate the market tightness and discourage investment

Doubts and risks

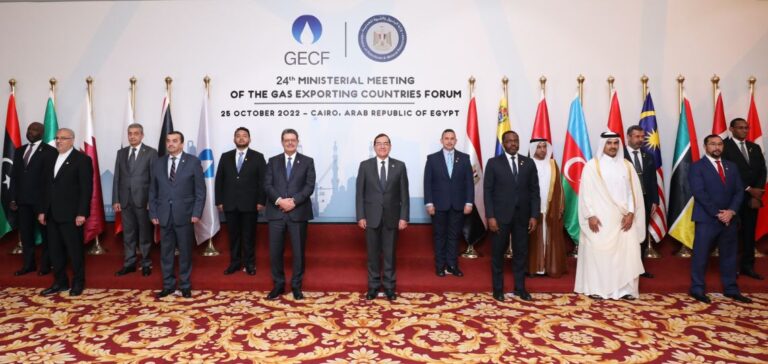

The GECF Ministerial Summit was held in Cairo, Egypt. The final communiqué states that gas markets are undergoing dramatic changes. Participants were skeptical of attempts to change the price discovery and risk management functions of markets.

The GECF also questions politically motivated price caps. At the same time, the European Commission is working with EU member states on potential market intervention measures. These interventions would include gas price cap mechanisms and dynamic pricing corridors.

Price volatility

The price of gas in Europe and Asia is extremely volatile until 2022. Indeed, new records are being set for European gas and conventional LNG reference prices. The TTF price in the Netherlands is at a record high of €319.98/MWh on August 26.

In addition, the JKM LNG spot price reaches the historical price of $84.76/MMBtu in March 2022. However, long-term contractual gas prices would be stable. GECF states that it is the underinvestment since 2015 that accounts for the current imbalance between supply and demand.

Expected investments

This underinvestment is due to low gas prices and the rhetoric of not investing in gas projects. The GECF assures that the tightening of the market should continue in the medium term. The majority of the new projects will not come on line until after 2025.

GECF recommends that more emphasis be placed on gas infrastructure. Population growth, a doubling of the world’s GDP and improved living standards are leading to an increase in the need for gas. Thus, the forum emphasizes the importance of timely investment to ensure market stability.