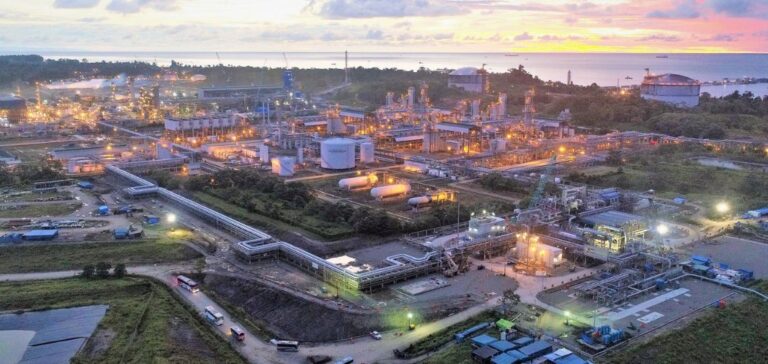

Tangguh, Indonesia’s LNG plant is expanding its capacity with the addition of a new Train-3 structure.

Increase in gas production

Tangguh will also benefit from a 20-year extension of a production sharing contract (PSC) with BP and its partners. The working areas are located in Berau, Muturi and Wiriagar in West Papua. Thus, the extension would allow BP and its partners to operate on the fields until 2055.

BP is attempting to increase Tangguh’s production capacity from the current 7.6 million tons per annum (MTPA) to approximately 11.4 MTPA. The new Train-3 plant is scheduled to begin operation in March 2023. BP thus obtains a longer contract to secure its long-term investment plan.

A growing demand for gas

Dwi Soetjipto, chairman of Indonesian upstream regulator SKK Migas, says:

“In order to maintain production from the LNG-3 train, BP has committed to further exploration activities at several sites… BP has also committed to preparing a 2×90 MMSCFD gas pipeline to support industry development in Papua.”

Production from the Tangguh LNG plant is expected to fall before 2030 in the absence of new exploration. According to the authorities, Tangguh’s gas production is needed to meet Indonesia’s growing energy demand.

Indonesia declares the development of BP’s Ubadari field, also in West Papua, to be part of the country’s list of strategic projects. The same is true for its Carbon Capture, Utilization and Storage (CCUS) project. These projects are necessary to make Indonesia cleaner energy.