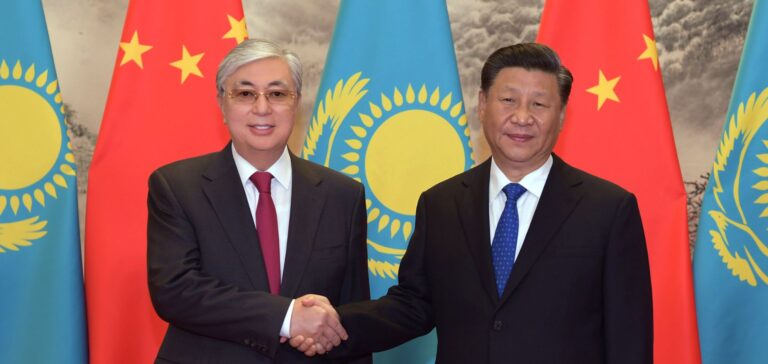

China Petroleum & Chemical Corporation (HKG: 0386, “Sinopec”) signed a key agreement with KazMunayGaz, Kazakhstan’s national oil and gas operator, for the development of a polyethylene project in the Atyrau region on May 18 in Xi’an, China. The agreement, signed during Kazakh President Kassym-Jomart Tokayev’s visit to China, marks Sinopec’s commitment to participating and advancing the project as a cooperative partner.

The polyethylene project will be the largest natural gas and chemicals project in the region, and the investment decision is expected to be finalized in 2024. When Sinopec officially joins the project in the future, all parties will sign a share acquisition agreement and other relevant legally binding documents.

Solid cooperation

Sinopec and KazMunayGaz are long-standing partners with a solid base of cooperation, and the signing of this agreement takes their partnership to a new level. It will leverage Sinopec’s considerable advantages in engineering, marketing, sales, production and operations, as well as KazMunayGaz’s strong local market capabilities and wealth of resources, to promote mutually beneficial cooperation and achieve win-win development.

Sinopec is a listed company active in domestic and international markets, with integrated upstream, midstream and downstream operations. It has strong core businesses in oil and petrochemicals, as well as a comprehensive marketing network. Its parent company, China Petrochemical Corporation, is the world’s largest refiner and third-largest chemical company, ranked in the top five of Fortune’s Global 500.

Based in Astana, KazMunayGaz represents the interests of the Republic of Kazakhstan in the oil and gas industry. Its main activities cover oil and gas exploration and production, petroleum processing, sales of petroleum products, storage, pipelines and petroleum services.