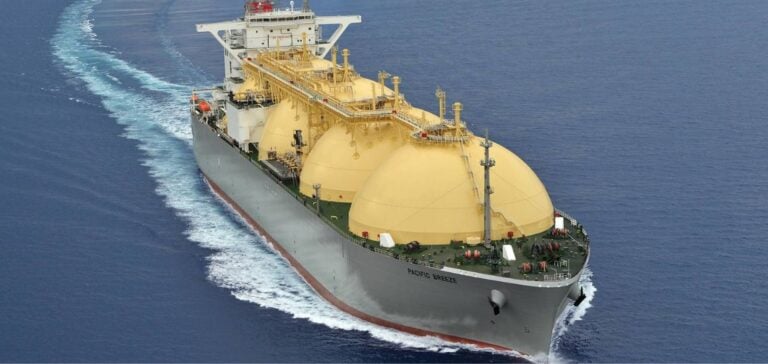

From March 27 to 29, JERA had to impose fuel restrictions, increasing the capacity outage to 6.72 GW due to unfavorable ocean conditions that delayed LNG deliveries. These measures were taken in response to delays caused by high waves in mid-March, which prevented LNG vessels from docking and exacerbated a drop in LNG stocks due to increased demand.

Impact and management of restrictions

Despite the restrictions, the Tokyo area maintained a reserve capacity of over 10%, deemed sufficient to cover demand during this period. Tokyo Gas officials confirmed that LNG deliveries to their Negishi, Ohgishima and Sodegaura terminals, operated jointly with JERA, had gone according to plan.

Impact on LNG stocks and market responses

JERA’s LNG stocks fell to 1.52 million tonnes on March 24, the lowest level since the end of January 2021, when stocks stood at 1.49 million tonnes. This situation highlights Japan’s sensitivity to fluctuations in the LNG market, exacerbated by increased demand following colder-than-usual temperatures.

Policy response and preventive measures

Faced with these challenges, the Ministry of Economy, Trade and Industry (METI) has drawn up guidelines to ensure adequate LNG stocks, particularly during peak demand seasons. A METI official expressed his intention to investigate the causes of the fuel restrictions and stressed the importance of maintaining adequate capacity to avoid significant impacts on gas-oil generation capacity.

Takayuki Nogami from JOGMEC highlighted the risks of power supply disruptions in the event of rapidly declining LNG stocks, exacerbated by delays in ship arrivals and increased demand due to falling temperatures.