The global LNG market is growing fast, with increasing demand in Asia, especially Japan and South Korea. Canada, with its abundant resources and geographical proximity to Asia, is well placed to capitalize on this demand. However, realizing this potential is hampered by complex regulatory challenges that slow the development of LNG projects.

Current LNG projects

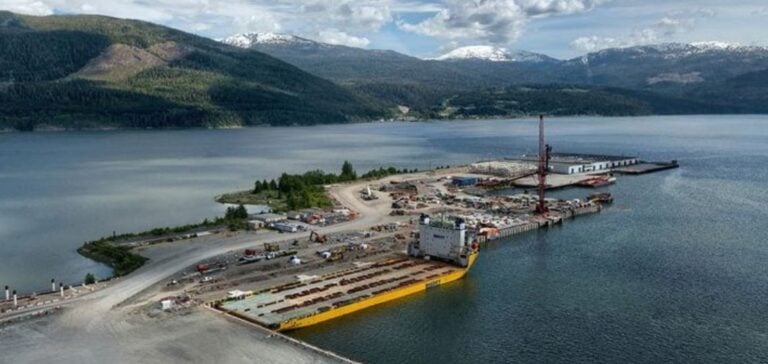

Canada currently has five LNG projects under development on the West Coast, the most advanced of which is LNG Canada. This project, a joint venture between Shell, Petronas, PetroChina, Mitsubishi Corp. and Korea Gas Corp. is in the final stages of construction, with start-up scheduled for summer 2025. LNG Canada, located in Kitimat, British Columbia, is expected to export one vessel every two days to Asia, meeting growing energy demand. LNG Canada, with a production capacity of 12 million tonnes per year, is designed in two equal phases. Each phase will comprise two liquefaction trains, enabling a gradual increase in export capacity. The joint venture partners plan to take their share of LNG to supply Asian markets, thereby strengthening energy links between Canada and Asia.

Strategic and logistical advantages

One of the main advantages of Canadian LNG is its proximity to Asian markets. For example, the port of Prince Rupert in British Columbia is only eight to nine days’ sailing from Tokyo, compared with 16 to 18 days from the U.S. Gulf Coast. This proximity reduces not only transport time, but also logistics costs, making Canadian LNG particularly attractive to Asian buyers. Canada’s LNG infrastructure also benefits from a geographical advantage, avoiding maritime congestion points such as the Panama Canal and the Strait of Hormuz. This strategic position enables more direct and reliable delivery to Asian markets, a major advantage in the face of international competition.

Regulatory challenges and solutions

Despite these advantages, LNG projects in Canada face significant regulatory hurdles. The complexity of approval processes, involving several levels of governance, slows down project progress. However, Canada’s LNG developers have made progress in navigating these challenges. LNG Canada, for example, has successfully obtained the necessary permits and is now ready for production. Canadian regulators work closely with developers to ensure that projects meet the country’s strict environmental standards. This collaboration aims to minimize environmental impact while maximizing economic and energy benefits for Canada.

Outlook and future of Canadian LNG

The future of LNG in Canada looks promising, with increased capacity to meet global energy needs, particularly in Asia. Asian buyers, in search of reliable and diversified energy sources, see Canada as a strategic partner. In addition to energy security, Canada’s focus on low-carbon LNG enhances the attractiveness of its exports. The impact of recent geopolitical events, such as the Fukushima disaster and Russia’s invasion of Ukraine, has intensified demand for stable, secure sources of LNG. Canada, with its vast natural resources and projects under development, is well placed to play a crucial role in the world’s energy supply.

Canada is poised to become a major player in the global LNG market. Ongoing projects, combined with logistical advantages and growing demand in Asia, position the country for significant growth. However, realizing this potential will depend on the ability to navigate regulatory challenges and maintain high environmental standards.