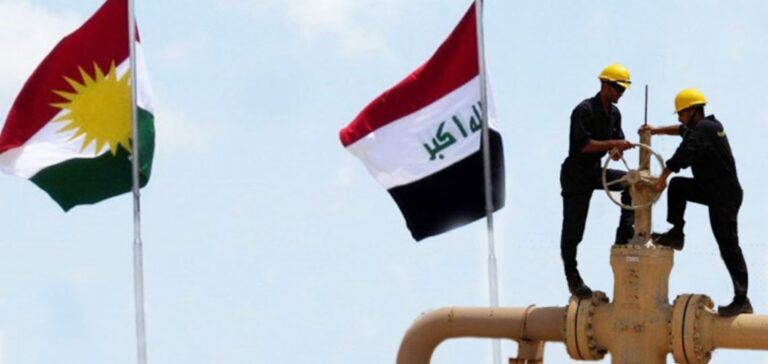

Oil exports from the autonomous region of Iraqi Kurdistan to Turkey could resume within a week, according to Iraq’s Minister of Oil, Hayan Abdel-Ghani. This restart would put an end to a suspension that has lasted since 2023 due to legal and technical disputes regarding the management of oil produced in the region.

An Agreement Between Baghdad and Erbil

Baghdad and Erbil have reached a consensus allowing Iraq to receive at least 300,000 barrels of oil per day for export via the Turkish terminal in Ceyhan. The Oil Minister specified that this volume would be subject to a mechanism defined between the federal and regional authorities. An Iraqi delegation will travel to Erbil to finalize this process.

The pipeline linking Iraqi Kurdistan to Turkey has been closed since March 2023 following a ruling by the arbitration court of the International Chamber of Commerce in Paris. This court ruled in favor of the Iraqi government, stating that it had exclusive authority over the management of oil produced within its borders, thereby ending independent Kurdish oil exports.

A Significant Economic Impact

Until the pipeline’s suspension in 2023, Kurdish oil exports were a major source of revenue for the region. Their halt has led to estimated losses of $20 billion, according to the Association of the Petroleum Industry of Kurdistan, which represents international oil companies operating in the region.

Beyond financial losses, the interruption of Kurdish oil exports has fueled tensions between Baghdad and Erbil. One key disagreement revolved around production and transportation costs, which needed to be shared between both parties.

Expected Cooperation with Ankara

The arbitration court’s decision also compelled Turkey to suspend imports of Kurdish oil and to pay compensation to Iraq for past exports. A return to normal operations will require trilateral cooperation between Baghdad, Erbil, and Ankara, particularly to ensure the resumption of flows through the port of Ceyhan.

If discussions progress favorably, reopening the pipeline could mark a turning point in stabilizing relations between the Iraqi central government and the Kurdistan region while enabling a production rebound amid a period of volatility in global oil markets.