Growing demand for renewable energy is driving Taiwanese companies to expand internationally. GreenRock Energy is targeting Malaysia’s potential, aligned with the government’s target of 40% green energy by 2035. This partnership marks the first time a Taiwanese company has been involved in Malaysian energy projects.

Malaysia’s Energy Ambitions

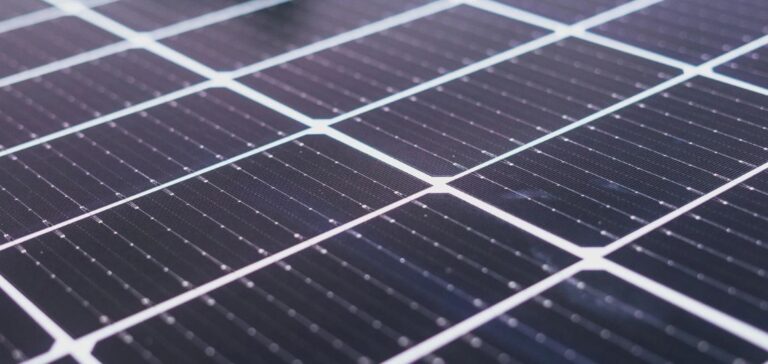

The Malaysian energy market is actively transforming itself to meet its green objectives. The LSS5 solar program, launched by the government, targets a total capacity of 2 GW of renewable energy. This initiative complements the National Energy Transformation Policy (NETR), aimed at reducing carbon emissions and making Malaysia a low-carbon nation by 2040. To support these ambitions, the government also plans to adopt a third-party access mechanism and establish a renewable energy trading center, enabling the export of renewable energy across borders and accelerating Southeast Asia’s energy transition.

Enhanced collaboration

GreenRock’s participation in Malaysia’s large-scale solar project demonstrates its ambition to expand internationally and its strong capabilities in the renewable energy sector. Despite the complexity and intense competition of local politics, the collaboration with Solarvest will overcome these challenges thanks to their combined expertise.

Solarvest Leadership

Solarvest, Malaysia’s solar market leader, has a record of 1.2 GW of projects in the region. It provides comprehensive services, including the development, design, construction, operation, maintenance and management of solar assets. In addition to Malaysia, Solarvest has developed activities in six other Asian countries: Taiwan, Singapore, the Philippines, Vietnam, Thailand and Indonesia. In partnership with GreenRock in Taiwan, Solarvest is working on large-scale agrivoltaic and aquavoltaic projects, targeting 500 MW.

A strategic gateway

Malaysia is seen as a strategic gateway for expanding the green energy footprint in Southeast Asia. Recognizing favorable government policies and the growing demand for renewable energy, GreenRock will leverage its local collaborations to strengthen its regional technical and project management capabilities. This partnership, targeting 1 GW of renewable energy projects over the next five years, marks a milestone for a Taiwanese company in the Malaysian market. GreenRock anticipates regional expansion by building on Solarvest’s strengths, fostering the region’s energy transformation and sustainable development.