The price of gas on the European market fell below 50 euros per megawatt hour on Friday, nearly seven times lower than its all-time high in the early days of the Russian invasion of Ukraine. Fears of shortages at the height of winter due to Russia’s crucial role as a supplier to Europe have subsided.

Factors that have impacted the market

“European gas prices have fallen by 50% since November thanks to abnormally high temperatures” limiting heating use “and limited competition for liquid natural gas (LNG) from China when anti-Covid measures were still in effect,” commented Edoardo Campanella, analyst at UniCredit.

Prices still high despite the decrease

The Dutch TTF futures contract, which is a benchmark in the European market, was trading for less than 50 euros per megawatt-hour (MWh) on Friday morning for the first time since September 2021. Prices remain historically high. Before 2021 and the start of tensions over Russian deliveries, they had rarely exceeded 35 euros. The European Bank for Reconstruction and Development (EBRD) has significantly lowered its growth forecasts for the countries it covers, to 2.1% for 2023 against 3% previously, pointing to gas prices, “six times higher than across the Atlantic.

A short-lived drop in prices

“Without the drastic reduction in Russian gas supplies, Europe could currently be enjoying above-average growth rather than suffering stagnation,” laments Berenberg analyst Salomon Fiedler. And the respite provided by lower prices for countries struggling with rampant inflation could be short-lived. “Despite high reserves, if temperatures normalize in the winter of 2023-24, lowering consumption will be more difficult, making competition with China for LNG more intense,” Campanella warns.

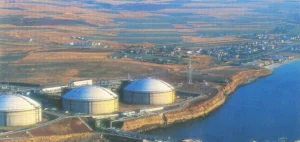

An increase in LNG imports

Europe has increased its LNG imports by 60% in 2022 to compensate for declining Russian supply, according to a report released Thursday by oil and gas giant Shell, which predicts the market will remain “tight” in the coming years due to competition among buyers and a lack of supply growth.

Decline in oil prices

On the oil side, European Brent crude for March delivery gave up 1.37% to 83.96 dollars around 09:45 GMT (10:45 in Paris) and U.S. WTI lost 1.47% to 77.34 dollars.