These projects aim to reduce carbon dioxide (CO2) emissions from Strathcona’s steam-assisted gravity drainage (SAGD) facilities in Saskatchewan and Alberta.

Financing Structure and Cost Breakdown

The strategic partnership between FCC and Strathcona plans to capture and store up to two million tonnes of CO2 per year. Each entity will invest up to $1 billion to finance CCS projects. Strathcona, Canada’s fifth largest oil producer, will be responsible for the construction, ownership and operation of the projects. The FCC will earn financial returns based on the volumes of CO2 captured and operating costs. This project is part of a global drive to keep CO2 emissions at oil production sites to a minimum.

The collaboration is based on a risk-sharing model in which Strathcona assumes the carbon price risk and the CFC shares the risks associated with project costs and CO2 capture efficiency. The fixed price per tonne of CO2 will be determined at the final investment decision (FID), scheduled for 2025. The FCC is initially committed to investing up to $500 million, with the possibility of increasing this commitment to $1 billion.

Financial Conditions and Risks

Under the agreement, Strathcona will mainly finance its share of the costs through investment tax credits and other subsidies. CFC, in turn, will earn a target return over time from the annual cash flows generated by each CCS project. These cash flows will depend on the volumes of CO2 actually captured, actual operating costs and a fixed carbon price guaranteed by Strathcona.

The partnership also includes information and verification rights for the FCC, including rigorous oversight of the construction and operation of CCS projects. This enables the FCC to ensure that projects meet established efficiency and cost-effectiveness criteria.

Progress and Regulatory Approvals

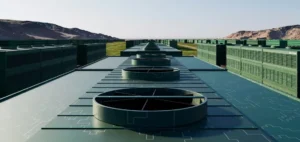

Strathcona has already achieved significant milestones by obtaining rights to inject CO2 into saline aquifers in Saskatchewan. This makes Strathcona the first oil sands producer in Canada to be authorized to capture and permanently store CO2. Strathcona’s oil sands facilities at Lloydminster and Cold Lake are located close to suitable storage reservoirs, enabling direct on-site injection.

The FCC, with its $15 billion in public funds, aims to attract private capital to support low-carbon projects. By using investment instruments to absorb certain risks, the FCC encourages private investment in decarbonization technologies essential to Canadian industries.

Economic impact

This partnership aims to reduce CO2 emissions from the Canadian oil and gas sector, which accounts for a significant share of the country’s GDP. In addition to reducing emissions, the partnership is designed to demonstrate the economic viability of large-scale CCS projects. The FCC, with a target repayment period of 10 years, will monitor the construction and operation of the projects to ensure their efficiency and profitability.

CCS projects will be funded 50% by FCC and 50% by Strathcona. The first CCS project, with a final investment decision scheduled for mid-2025, will be built in Saskatchewan. Strathcona is also in discussions with the Province of Alberta to obtain similar approval for its Cold Lake properties.

Role of the Canada Growth Fund

The CFC is a $15 billion public fund, independent of government, designed to attract private capital by absorbing certain risks in order to build Canada’s green economy. The CCF makes strategic investments to help Canada achieve its national economic and climate policy objectives, including reducing emissions and accelerating the deployment of key technologies such as CCS.

In this partnership, the CFC plays a crucial role in helping to finance a sector that is not yet well served by commercial lenders. This makes it possible to invest in projects that are essential for the decarbonization of hard-to-decarbonize industries, such as the oil and gas sector.