Gas demand in Europe fell sharply in the first half of 2023, and this trend looks set to continue in the second half of the year, says the Gas Exporters Forum (GECF), in a report seen by AFP on Thursday.

Gas storage in Europe ahead of winter despite falling consumption

Under scrutiny since the start of the war in Ukraine, which has complicated gas supplies to the EU deprived of Russian pipelines, consumption fell by 10.6% in the first half of 2023, or 21 billion cubic meters, according to the report. This decline can be explained “primarily by the exceptionally warm winter that enveloped the EU in the first quarter of 2023”, leading to a drop in household heating demand, according to the report.

He also cites the voluntarist policy of Brussels, which has set a 15% consumption reduction target for its 27 member countries. In the second half of 2023, “the probability of observing similar trends in natural gas consumption in Europe remains particularly high”, according to the GECF, which represents a dozen gas-exporting countries outside the USA.

In particular, it relies on the most recent weather forecasts “which suggest that the fourth quarter of 2023 will be characterized by relatively warmer conditions”.

Beyond this element, which remains open to question, the report underlines the need to pursue Europe’s voluntarist sobriety policy. The report mentions the fall in demand from the industrial sector, “unlikely to see any substantial recovery over the next six months”. GECF points to the first half of 2023 as evidence of this: despite a fall in gas prices in Europe, industrial demand has not returned to pre-decline levels.

“For 2023, we expect a drop of around 8% to 10% compared with 2022,” says the Forum.

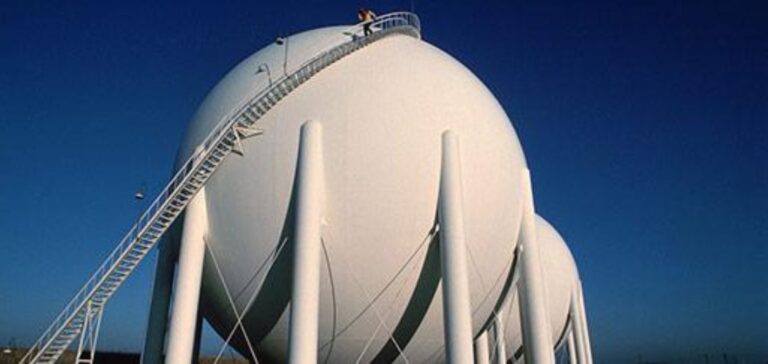

This is not stopping European countries from filling their storage facilities in anticipation of winter: according to aggregated data from Gas Infrastructure Europe (GIE), an association of European gas infrastructure operators, European storage facilities were on average almost 90% full on Thursday. But they will only cover a fraction of consumption. France, for example, has 130 TWh of underground natural gas storage capacity, or less than a third of its annual gas consumption of around 450 TWh, according to the French Energy Regulatory Commission.