Groupe Evergaz issues bonds convertible into shares worth 20 million euros. The bonds were subscribed by Bpifrance’s ETI 2020 funds, Eiffel Gaz Vert and Eiffel Investment Group. The latter are key players in the field of energy transition.

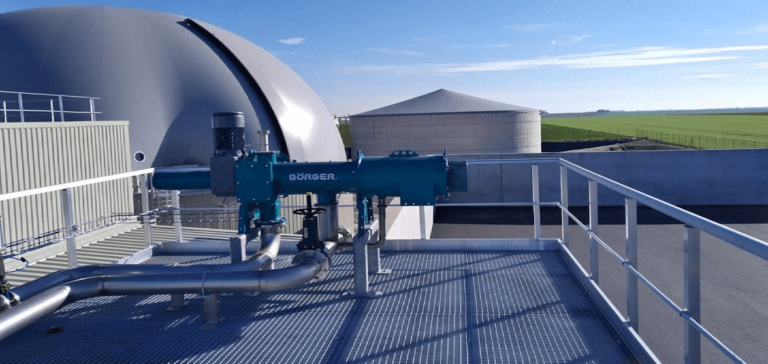

Evergaz owns and operates 27 methanization units. This represents an annual production capacity of 1.1 TWh HCV (biomethane equivalent), equivalent to an installed capacity of 49.7 MWe. This is equivalent to the annual electricity consumption of nearly 130,000 households. In addition, Evergaz has 15 years’ experience in the methanization sector in France, Germany and Belgium.

Acceleration of the Growth Plan

This €20 million issue marks a new stage in the acceleration of Evergaz’s strategic growth plan on a European scale. The plan is based on three main areas of development:

- Continued development through the acquisition or construction of new units in the field of agricultural and industrial local anaerobic digestion in France, Belgium and Germany, while expanding activities in new regions of Europe.

- Acceleration of the optimization and expansion program at existing French, German and Belgian sites.

- Investment in human and material resources to support growth at Group units, including bio-waste treatment, biogenic CO2 production and heat recovery.

European leadership in anaerobic digestion

Evergaz aims to become a European leader in anaerobic digestion. This offers unique development potential in many European markets. Methanization is an energy source that does not emit additional CO2. It has several advantages over other renewable energy sources:

- Waste treatment process

- Non-intermittent renewable energy production

- Easily storable energy in the form of biomethane

- Production of green manures to replace synthetic fertilizers

- Use of biowaste from January 2024 in accordance with legislation.

Partner commitment

Fabrice Hernu, Investment Director at Bpifrance, said: “We are delighted to support the development of Evergaz, a member of the second promotion of Bpifrance’s Waste Transformation and Valorization Accelerator in 2022. What’s more, we’re convinced that the group’s activity is fully in line with our actions in favor of a decarbonized economy.”

Marc-Etienne Mercadier, Director at Eiffel Investment Group, added. They have been Evergaz partners since 2017, and are delighted to renew their trust in the Group and support this new phase in its development. Convinced of the key role of renewable gases in the energy transition, the development of circular economy models and the decarbonization of our territories, we are delighted with the development of Groupe Evergaz’s activities.”

Evergaz co-founders Alain Planchot and Frédéric Flipo commented: “We are delighted with the support and confidence shown in us by Bpifrance and Eiffel Investment Group. We are convinced that their commitment will enable Evergaz to take a major step forward. But it will also enable us to pursue our sustained growth dynamic, with the ambition of becoming an independent leader in biogas production in Europe. This will contribute to Europe’s energy transition and energy independence.”

Data and sources

1 Data take into account 100% ownership of methanization units.

2 Assumptions: methane (CH4) content of biogas 54%, electrical efficiency of cogeneration motors 40.8%, gross calorific value of CH4 10.87 kWh, 250 Nm3 of CH4 per MWhél, 8410 hours of annual operation of anaerobic digestion units, corresponding to a target availability rate of 96%.

3 Assumptions: installed capacity equivalent to 49.7 MWe, 8410 hours of annual operation of anaerobic digestion units, equivalent household electricity consumption of 3245 MWhe.

4 Source: study by Deloitte

About Evergaz, Bpifrance, Eiffel Gaz Vert and Eiffel Investment Group

Evergaz owns and operates a fleet of biogas production plants in Europe. This contributes to the management of organic waste while producing renewable green energy and a natural fertilizer. Alain Planchot, Chairman and CEO, and Frédéric Flipo, Managing Director and co-founder, lead Evergaz.

Bpifrance finances companies at every stage of their development, providing credit, guarantees and equity capital. The company supports innovation and international projects, with a network of regional offices to provide close support to entrepreneurs. Fabrice Hernu is Investment Director at Bpifrance.

Eiffel Gaz Vert is the 1st European fund dedicated to renewable gases. It invests in renewable gas production, distribution and equipment projects. Marc-Etienne Mercadier, Director at Eiffel Investment Group, manages this fund.

Eiffel Investment Group is an asset manager with €5.5 billion in assets under management. The Group finances companies through a variety of strategies. These include private equity, energy transition infrastructure, and listed equities and loans.