A dam in the DRC could be built. Australia’s Fortescue Metals said it was in talks with the government of the Democratic Republic of Congo. He hopes to be chosen to develop a hydroelectric project that could become the world’s largest.

DRC dam: Fortescue negotiates to develop the Grand Inga project

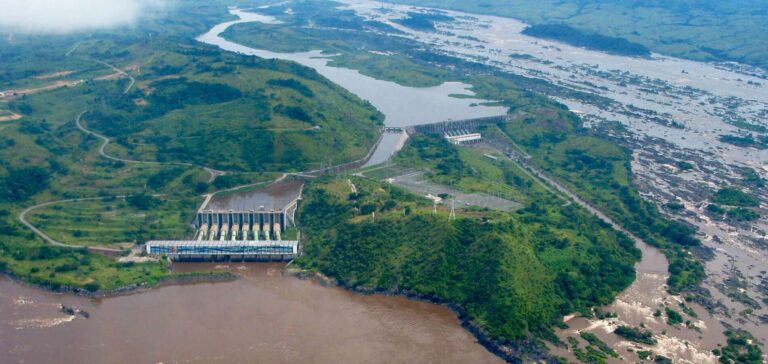

Fortescue Metals Group confirms that discussions are underway with the government of the Democratic Republic of Congo (DRC). Fortescue Future Industries has been granted exclusive rights for the potential development of the huge Grand Inga project.

Grand Inga contains seven potential hydroelectric power stations. It could generate more than 40,000 MW of electricity to supply large populations on the African continent. If completed, the project will eclipse the combined electricity production of the Three Gorges in China and Itaipu in Latin America.

The loss of a $73 million equity stake

However, the DRC has had difficulty in obtaining funding for this project. The World Bank cancelled its $73 million participation in 2016. At issue were environmental and social studies carried out after the Inga agency was placed under Kabila’s direct control.

In the absence of hydroelectric power stations, the DRC is unable to provide light for the vast majority of its 80 million inhabitants. To make up for this shortfall, the government plans to build six additional dams. But these projects have been delayed several times by funding difficulties and disputes with partners.

Two dams for 1,800 MW

The two existing dams, completed in 1972 and 1982, have a combined installed capacity of almost 1,800 MW. In 2018, Chinese and Spanish consortiums signed an agreement to develop a third dam, called Inga 3.

But work has not yet begun, due to questions about financial viability. In addition, one of the main Spanish companies involved in the agreement, Actividades de Construccion y Servicios, withdrew from the project last year.

DRC dam: $80 billion investment

Fortescue’s involvement is the latest twist in Congo’s decades-long efforts to develop Inga. The proposed expansion would roughly double the size of China’s Three Gorges Dam, currently the largest in the world. Total development costs have been estimated at up to $80 billion.

The discussions with Fortescue could mark a new change of direction on the part of the Congolese government. If completed, the Grand Inga dam could help overcome electricity shortages. These are a major obstacle to the development of the Congo and Africa in general.

Meeting with the President of the DRC

Fortescue Chairman Andrew Forrest recently met DRC President Felix Tshisekedi to discuss the project. Mr. Forrest stated that Fortescue would use Inga’s energy to produce hydrogen, which would be exported worldwide. In particular, he told reporters:

“The capital cost of this project will amount to several tens of billions of dollars. Direct and indirect jobs will number in the hundreds of thousands.”

Fortescue aims to develop its renewable energies sector

Andrew Forrest wants to help relaunch the hydroelectric project, as part of his green energy development strategy. He is looking for large-scale renewable projects.

Indeed, he has set himself the goal of transforming Fortescue. It aims to go from being the world’s fourth-largest shipper of iron ore to a major producer of clean energy. The company has declared that it will set aside 10% of its annual profits to invest in ecological initiatives.

Many obstacles despite government promises

No formal agreement has yet been reached. The project could face further obstacles, as Congo regularly ranks as one of the most corrupt countries in which to do business. The management of the Inga project was also criticized under Kabila for its lack of transparency.

Other negotiations in progress

However, Mr. Tshisekedi has promised to connect half the population to the network within the next decade. The development of Grand Inga is one of his priorities, according to his advisors. He doesn’t just negotiate with Fortescue.

Last year, he met with German turbine manufacturers and natural gas companies. They too are looking to produce green hydrogen in their own country.