Kuwait has recorded its first budget surplus in nine years during the 2022-2023 financial year, the Ministry of Finance announced on Wednesday, explaining this result by the surge in oil prices last year.

Kuwait recorded its first budget surplus in nine years thanks to higher oil revenues.

The Gulf emirate, whose revenues are largely dependent on hydrocarbons, ended its fiscal year at the end of March with a surplus of $21 billion, “the first in nine years”, the ministry said in a statement.

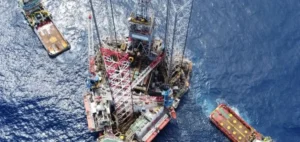

Over 92% of revenues were derived from oil after the price surge that followed Russia’s invasion of Ukraine in February 2022. Oil revenues for the fiscal year that began in April 2022 reached $87 billion, up 64% on the previous year, according to the Ministry. The average price per barrel of oil for the year was $97.1, up 21.4% on the previous year. Production reached 2.7 million barrels per day.

Revenues for the current year are expected to decline, however, due to lower oil prices. The draft budget for fiscal 2023-2024, published in January, was calculated on the basis of an oil price of $70 a barrel. Kuwait, which borders Saudi Arabia and Iraq, is home to 7% of the world’s crude oil reserves, making it one of the world’s leading oil exporters. The country has little debt and one of the strongest sovereign wealth funds in the world.

However, the emirate suffers from serious political instability, linked to the constant tug-of-war between the elected Parliament and the governments installed by the ruling family, which exerts a strong hold on political life despite a parliamentary system in place since 1962. This instability, which has led to seven general elections in just over a decade, is scaring off investors and hindering the implementation of the reforms the economy needs. Kuwait’s fifth government in less than a year was sworn in in June, in the wake of elections that gave the opposition control of Parliament.