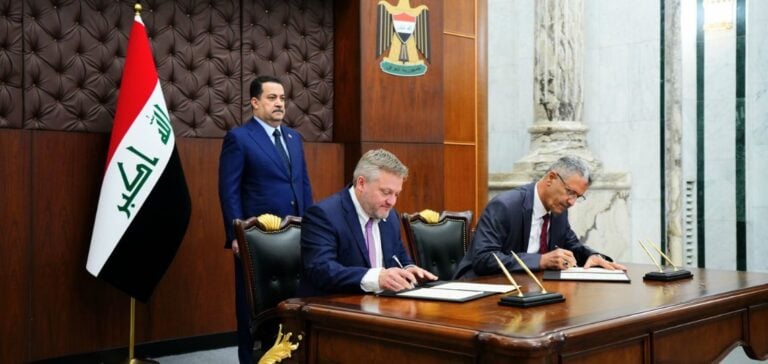

BP and the Iraqi government sign a memorandum of understanding for the rehabilitation and development of four oil and gas fields in Kirkuk.

The fields concerned are Kirkuk, Bai Hassan, Jambur and Khabbaz, all operated by the North Oil Company.

The agreement, signed by Iraqi Oil Minister Hayan Abdel-Ghani and BP CEO Murray Auchincloss, marks an important milestone in the collaboration between Iraq and BP.

This initiative is part of the Iraqi government’s efforts to maximize the exploitation of its energy resources and increase oil production.

The aim is to stimulate investment in gas and solar energy, thereby strengthening the country’s energy security and diversifying its sources of revenue.

BP and Iraq: a historic relationship

Present in Iraq since the 1920s, BP plays a crucial role in the country’s oil sector.

Currently, Iraq is the second largest exporter within the Organization of Petroleum Exporting Countries (OPEC), with daily production of four million barrels of crude and proven reserves of 145 billion barrels.

These resources will enable the country to maintain production for another 96 years, according to World Bank estimates.

Minister Abdel-Ghani recently expressed the hope of increasing Iraq’s oil reserves to over 160 billion barrels.

Oil accounts for 90% of Iraq’s revenue, but despite this wealth, the country remains dependent on imports to meet its domestic energy needs.

Diversification and energy independence

Iraq is seeking to reduce its dependence on gas imports from Iran, which are crucial to its electricity production.

Baghdad has begun importing electricity from Jordan and Turkey, and plans to connect to the power grids of Gulf countries in the coming months.

These measures are aimed at alleviating chronic power cuts, which are particularly frequent in summer.

The development of the Kirkuk oil and gas fields with BP could play a key role in this transition.

By increasing its gas production, Iraq hopes to strengthen its energy security and reduce its dependence on imports.

Prospects for Iraq’s energy future

The agreement with BP marks a turning point for Iraq in its quest for energy autonomy.

The development of the Kirkuk fields should not only boost oil and gas production, but also contribute to the country’s economic stabilization.

By focusing on diversifying and optimizing its resources, Iraq aims to overcome its energy challenges and consolidate its position on the world market.

This initiative could also pave the way for new investment opportunities and international collaboration in Iraq’s energy sector.

The success of this project will depend on the effective implementation of the agreements and the government’s ability to maintain a stable, business-friendly environment.