In a controversial move, the Biden administration has once again thrown its support behind the Mountain Valley Pipeline project. The initiative is supported by a key Democratic senator who seeks to expedite permitting for fossil fuel and electricity transmission infrastructure projects.

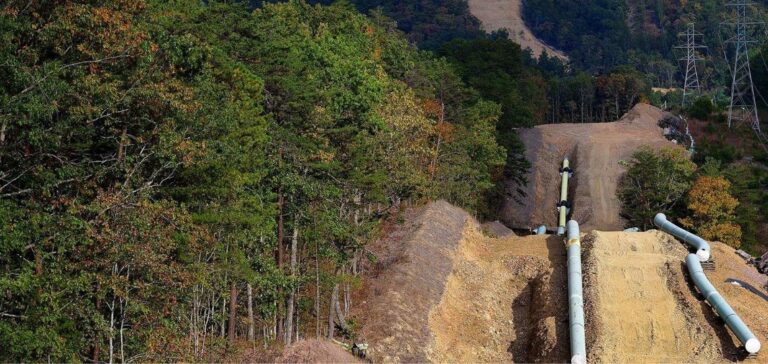

Mountain Valley: Next steps for $6.6 billion gas project

The $6.6 billion Mountain Valley Pipeline, developed by Equitrans Midstream Corp (ETRN.N), has been heavily criticized by environmental activists, but has received support from Biden administration officials, including Energy Secretary Jennifer Granholm. She said the U.S. must focus on both energy security and the transition to renewable energy.

The Bureau of Land Management (BLM), an agency under the Department of the Interior, said in a statement, “The BLM today issued a formal Decision regarding the Mountain Valley Pipeline. The BLM is now moving to the next step, which is processing the revised easement application for the project.” A BLM official said in an interview that the legal decision on the easement has been made, but has not yet been conveyed to the company. In accordance with the decision, the company cannot begin construction until it obtains the remaining federal and state permits, the official said.

Senator Joe Manchin, a conservative Democrat from West Virginia, has introduced legislation to accelerate fossil fuel projects and transmission line infrastructure to deliver electricity generated from renewable sources. His bill asks the Biden administration to approve the pipeline that would run through his state. Manchin’s proposal is one of several congressional initiatives on licensing.

Controversial decision to support Appalachian gas pipeline project despite environmental criticism

The pipeline project, which would unlock gas resources in the Appalachian region, the nation’s largest shale gas basin, still faces a review and permitting process, including in West Virginia. The project could still be delayed or blocked by lawsuits filed by its opponents.

Joe Manchin said the BLM’s decision is “one more step in the process of finalizing this vital energy infrastructure that will strengthen our energy and national security, boost West Virginia’s economy and benefit the entire country by bringing more than 2 billion cubic feet of natural gas online per day, helping to power homes and businesses.” The U.S. Forest Service on Tuesday issued a permit allowing the pipeline to cross the Jefferson National Forest, which lies between Virginia and West Virginia.

This decision to support the Mountain Valley Pipeline project, despite environmental criticism, highlights the tensions and trade-offs facing the Biden administration as it seeks to balance energy security in the short term with a transition to more sustainable energy sources in the long term.

While the transition to renewable energy is a priority for the Biden administration, it also recognizes the importance of existing energy resources in meeting the nation’s needs. However, the decision could be seen as a setback for environmental advocates, who have been calling for bolder action to combat climate change and reduce dependence on fossil fuels.