Aramco and Reliance Industries abandon the Reliance O2C project to rethink their cooperation.

The Indian company assures that it will remain a privileged partner of the Saudi giant.

Aramco and REliance launch the Reliance O2C project

The appointment of Aramco Chairman Yasir Al-Rumayyan to the board of Reliance Industries was intended to be a “win-win partnership”.

Saudi Aramco was to take a 20% stake in Reliance O2C for $15 billion.

However, the plan to create a Reliance O2C oil-to-chemicals entity was abandoned.

In the meantime, the Indian company had changed its business portfolio, forcing both parties to rethink their strategy.

Finally, this reconfiguration does not mean that the future partnership between the two companies has been abandoned.

Reliance Industries turns to renewable energies

Reliance Industries is determined to move into renewable energies with the aim of achieving carbon neutrality by 2035.

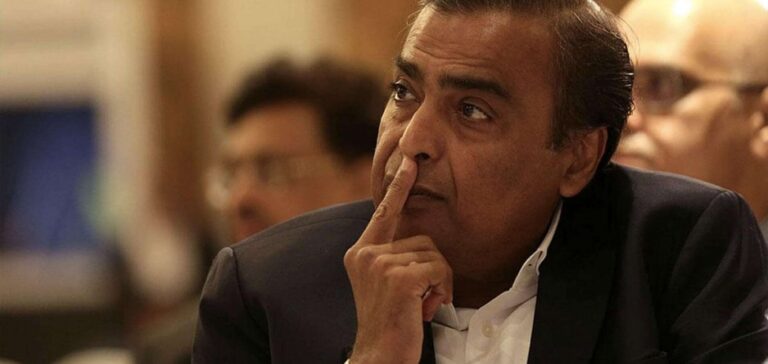

To kick-start this strategy, Chairman Mukesh Ambani has announced the construction of an intermittent energy storage facility.

The site chosen for the Dhirubhai Ambani Green Energy Giga Complex is located in Jamnagar.

The complex will comprise four plants, each with its own specialty.

Two of these will produce green hydrogen, electrolyzers and fuel cells.

The other two plants will focus on solar modules and batteries for intermittent energy storage.

The company plans to invest $10 billion in clean energies over the next three years.

Reliance Industries focuses on the domestic market

Reliance Industries operates the world’s largest refinery complex in the state of Gujarat, with a capacity of 1.2 Mb/d.

The company has ceased all shale gas activities in North America.

It has also signed an agreement with Ensign Operating III, LLC.

In so doing, it signals its intention to concentrate on its activities in India.

In India, per capita energy consumption is a third of the world average, and will continue to rise.