Alternus Energy is therefore preparing to acquire a further 15 MW of capacity in Poland and Italy.

Alternus Energy acquires 15 solar farms

The issue was priced at 102% of face value, giving a yield of 5.5%.

Representing a spread of around 608 basis points, settlement is scheduled for November 12 of this year.

Current outstanding bonds now stand at 130 million euros, with a borrowing limit of 200 million.

According to Vice President Vincent Browne, “our portfolio of operating European solar assets represents a very attractive investment opportunity”.

He argues that the investment will serve to strengthen the Group’s position in its key markets.

The aim is also to increase capacity by 12% and long-term EBITDA by around 8%.

The acquisition, scheduled for completion in December, aims to achieve an operating capacity of 3.5 GW by 2025.

An expanding group

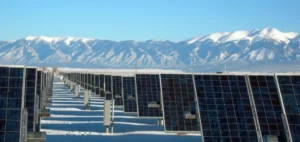

Alternus Energy Group is a pan-European independent power producer (IPP).

Based in Ireland, the company focuses on the medium-sizedsolar photovoltaic market.

It owns and operates several solar parks through long-term government contracts and/or power purchase agreements with off-takers.

Alternus also works with local and international specialist partners to acquire and build projects.

Present in Poland, Romania, Italy, the Netherlands and Germany, the company has a total capacity of 130 MW.

With this expansion into Poland and Italy, the company aims to become one of the largest pan-European IPPs by the end of 2020.