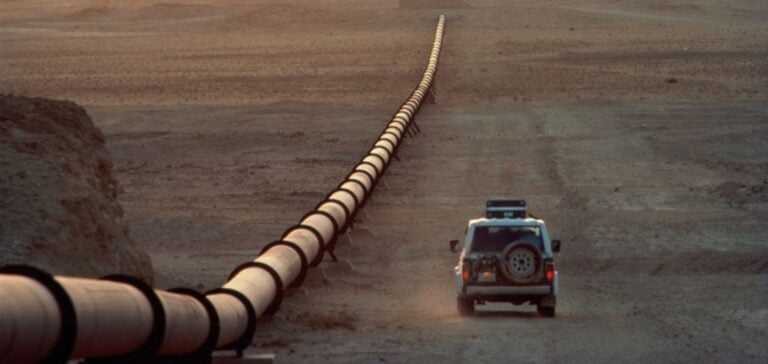

The pipeline between Niger and Benin, with a capacity of 110,000 barrels per day, has been completed. It quintuples Niger’s crude oil production capacity. It also significantly strengthens Niger’s position as an exporting country. According to S&P Global Commodity Insights, the first oil cargoes could be shipped as early as April. Sanctions imposed by ECOWAS, following a military coup, had delayed the project.

ECOWAS sanctions lifted

Following a military coup in Niger, ECOWAS imposed sanctions which were relaxed in February. This decision facilitated the completion of the work, particularly for pumping stations that had been waiting for blocked equipment. The resumption of imports was essential to the project’s progress.

Production and capacity

Niger, whose production was mainly domestic for lack of exports, will see its output increase from 20,000 to 110,000 b/d thanks to the pipeline. Commissioning is scheduled to start at 90,000 b/d, with a gradual ramp-up to full capacity. Storage tanks in Benin are being prepared for the first crude oil lifts in late April or early May.

Geopolitical and economic impact

The coup has reconfigured Niger’s international alliances, affecting its relations with France and bringing it closer to Russia and China. China National Petroleum Corporation played a key role in the completion of the pipeline. This project strengthens Niger’s export potential and demonstrates the strategic importance of investments in energy infrastructure.

With the start-up of the Niger-Benin pipeline, Niger is significantly increasing its oil production and export capacity. This development opens up new economic prospects for Niger and Benin, while highlighting the complexity of regional geopolitical issues. International partnerships play a crucial role in advancing large-scale energy projects.