- Energy Asset Transfer

- Focus

- Sector Analysis

Lyten has completed the acquisition of the Northvolt Dwa site in Poland, Europe’s largest energy storage system factory, and plans to deliver its first commercial units before the end of 2025.

Beijing calls Donald Trump's request to stop importing Russian crude interference, denouncing economic coercion and defending what it calls legitimate trade with Moscow.

The United States has called on Japan to stop importing Russian gas, amid rising tensions over conflicting economic interests between allies in response to the indirect financing of the war in Ukraine.

India faces mounting pressure from the United States over its purchases of Russian oil, as Donald Trump claims Prime Minister Narendra Modi pledged to halt them.

ABB recorded double-digit growth in sales of equipment for data centres, contributing to a 28% increase in net profit in the third quarter, surpassing market expectations.

Australian group Santos lowers its annual production forecast after an unplanned shutdown at the Barossa project and delayed recovery in the Cooper Basin.

SNG Holdings launched trial operations of a 2MW/6MWh energy storage facility in Gotemba, backed by Digital Grid and PHOTON, ahead of commercial commissioning scheduled for November.

Norwegian firm Scatec expands its presence in West Africa with two solar projects totalling 64 MW and a 10 MWh storage system, under lease agreements signed in Liberia and Sierra Leone.

GE Vernova will equip the Ialomiţa wind farm with 42 turbines of 6.1 MW, strengthening its presence in the European onshore wind sector with a 252 MW project in partnership with Greenvolt.

The Tokyo Bureau of Transportation is seeking a new electricity retailer for the output of its three hydropower plants, with a portion resold to power the city’s transport infrastructure.

The New South Wales Government has approved Ark Energy’s hybrid solar and battery project in Richmond Valley, combining a solar power plant and long-duration storage.

A report highlights the financial burden of fossil imports during the energy crisis and points to electrification as key to European energy security.

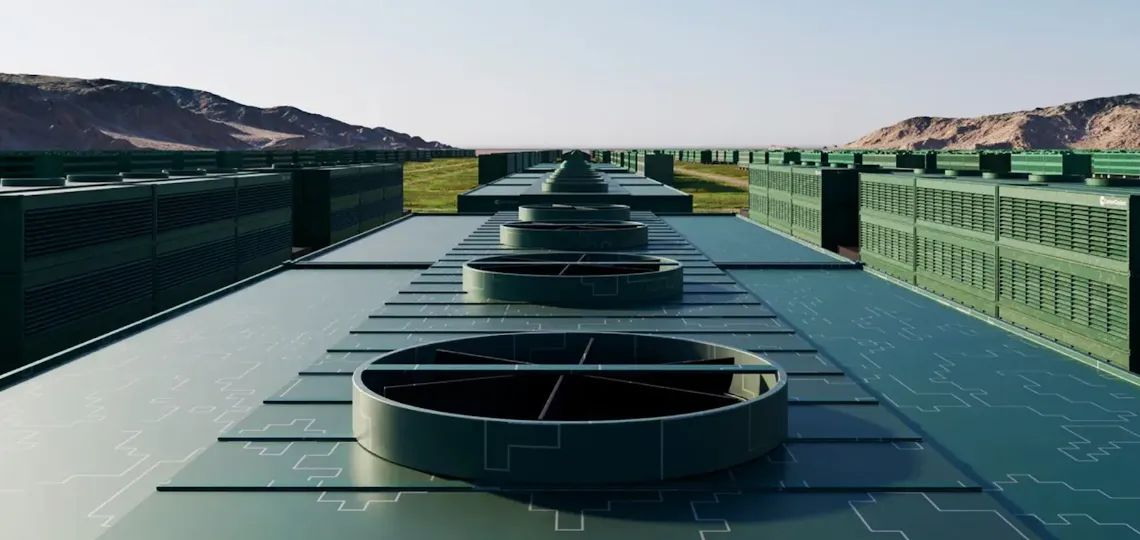

The Winchester project will combine 160 MW of storage with two 80 MW solar plants in Cochise County, with delivery expected in early 2027.

Asset manager Quinbrook expands its North American portfolio with a first Canadian investment by acquiring a strategic stake in developer Elemental Clean Fuels.

Green Plains has commissioned a carbon capture system in York, Nebraska, marking the first step in an industrial programme integrating CO₂ geological storage across multiple sites.

The increase in Brazil’s biodiesel blend mandate to 15% has reignited calls for stronger regulatory supervision as prices climb and budget constraints limit enforcement.

VoltaGrid partners with Oracle to deploy modular gas-powered infrastructure designed to stabilise energy use in artificial intelligence data centres while creating hundreds of jobs in Texas.

Nextracker will supply steel frames for solar modules to T1 Energy in a multi-year deal worth over $75mn, aiming to strengthen the local solar supply chain and reduce dependence on imported aluminium.

Three Crown Petroleum has started production from its Irvine 1NH well and plans two new wells in Wyoming, marking a notable acceleration of its deployment programme in the Powder River Basin through 2026.

Geronimo Power has started construction on the Bee Hollow solar park in St. Clair County, a 150 MW project expected to generate $54mn in direct economic impact for the region.

- Last news

Koshidaka Group signed a 10-year power purchase agreement with Farmland and Eneres to supply its Tokyo-area facilities with electricity from a 1.6MWAC solar plant located in Annaka.

The PairPHNXX system, designed for rapid deployment in areas without grid access, targets agricultural, military, and industrial markets with a turnkey modular technology.

Tamboran has completed a three-well drilling campaign in the Beetaloo Sub-basin, with 12,000 metres of horizontal sections prepared for stimulation and maintenance ahead of the commercial phase.

Energy Plug, Malahat Battery Technology and Quantum eMotion sign strategic agreement to develop quantum-secured energy storage systems, including a NATO-aligned defence initiative.

Valeura Energy partners with Transatlantic Petroleum to restart gas exploration in the Thrace basin, with testing and drilling planned this quarter in deep formations.

Waga Energy strengthens its presence in Brazil, betting on a rapidly structuring market where biomethane benefits from an incentive-based regulatory framework and strong industrial investment prospects.

Brookfield will invest up to $5 billion in Bloom Energy's fuel cells to power future artificial intelligence factories, initiating the first phase of a dedicated global digital infrastructure strategy.

Ascent Solar Technologies has delivered samples of its flexible photovoltaic technology to two companies for testing in extreme environments, at sea and in space.

Cenovus Energy has purchased over 21.7 million common shares of MEG Energy, representing 8.5% of its capital, as part of its ongoing acquisition strategy in Canada.

Nano Nuclear and the University of Illinois will begin drilling operations for the KRONOS MMR™ reactor on October 24, marking a key step toward commercialisation of the nuclear project on the Urbana-Champaign campus.

Geronimo Power has started construction of the Bee Hollow solar project, valued at $54mn, in St. Clair County, delivering jobs, tax revenue and a partnership with the IMEA municipal agency.

Calpine Corporation has finalised a public funding agreement to accelerate the construction of a peaking power plant in Freestone County, strengthening Texas’s grid response capacity during peak demand periods.

Greenflash Infrastructure has finalised the acquisition of Rock Rose, a 200 MW energy storage project located in Fort Bend County, to strengthen its ERCOT market portfolio.

Natura Resources is finalising construction of the MSR-1, an advanced liquid-fuel nuclear reactor, with a planned launch in 2026 on the Abilene Christian University campus.

JPMorganChase commits $10bn in direct investments as part of a $1.5tn plan to boost energy independence and strategic technologies, including next-generation nuclear power.

The British government has approved Tillbridge Solar Farm, a 500-MW solar power plant with 2,310 MWh of energy storage, developed by Tribus Clean Energy and Recurrent Energy.

Eight local associations in Normandy and Hauts-de-France will receive a total of €120,000, financed by revenues from three RWE wind farms, to support public-impact projects in 2025.

CWP Europe formalised two major projects in Albania and Montenegro with backing from the European Commission, reinforcing the Balkans’ integration into the European energy market.

A roadmap under development aims to establish regulatory and technical foundations for the deployment of small modular reactors, with the goal of strengthening national energy security and attracting private capital.

Naftogaz urges the European Union to use Ukraine’s gas storage capacity as part of a strategic reserve system, while calling for the end of storage filling obligations after 2027.