Spire has formalised the acquisition of the local natural gas distribution business of Piedmont Natural Gas in Tennessee, a subsidiary wholly owned by Duke Energy. The transaction, totalling $2.48bn, covers a portfolio of more than 200,000 customers mainly located in the Nashville area, one of the most dynamic markets in the United States. This acquisition strengthens Spire’s external growth strategy in the regulated sector, with the company already present in Missouri, Alabama and Mississippi.

Strengthening position in the gas market

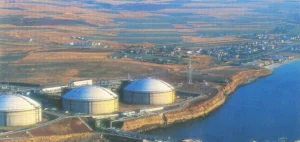

With nearly 3,800 miles of distribution and transmission pipelines, Piedmont Natural Gas is the largest investor-owned natural gas distributor in Tennessee. Integrating this business allows Spire to significantly increase its customer base, bringing the number served nationwide to nearly two million households and businesses. The transaction values the asset at a multiple of 1.5 times the estimated rate base for 2026 and aligns with Spire’s strategy focused on long-term value creation.

Immediate impact on financial results

Spire indicated that the transaction will be accretive to adjusted earnings per share from the first year, while supporting a long-term annual growth target of 5 to 7%. The closing of the deal is expected in the first quarter of 2026, subject to approval from the Tennessee Public Utility Commission, the Hart-Scott-Rodino process, and other customary closing conditions.

Integration prospects and regional dynamics

After the closing, Piedmont Natural Gas customers in the Nashville area will be served by a new entity, Spire Tennessee. This integration will allow Spire to benefit from a regulatory environment considered conducive to investment in the state, while offering new growth opportunities thanks to the demographic and economic momentum in the Nashville area. According to Scott Doyle, president and chief executive officer of Spire, the company aims to “continue the development of reliable and secure services” for its new customers.

The deal comes amid sustained growth in energy demand in Tennessee, with a steady increase in customer numbers and investments in gas infrastructure integrity. Harry Sideris, president and chief executive officer of Duke Energy, highlighted that this sale will allow his group to fund new projects in response to the region’s development momentum.

The teams and customers of Piedmont Natural Gas will thus join a group active in several southern US states, positioning Spire as a major player in the regulated gas distribution market.