Globeleq, an Africa-based independent power producer, has signed a share purchase agreement with the Norwegian development fund Norfund to acquire a 51% majority stake in the Lunsemfwa Hydro Power Company (LHPC), an active operator in Zambia.

Expansion of renewable energy portfolio

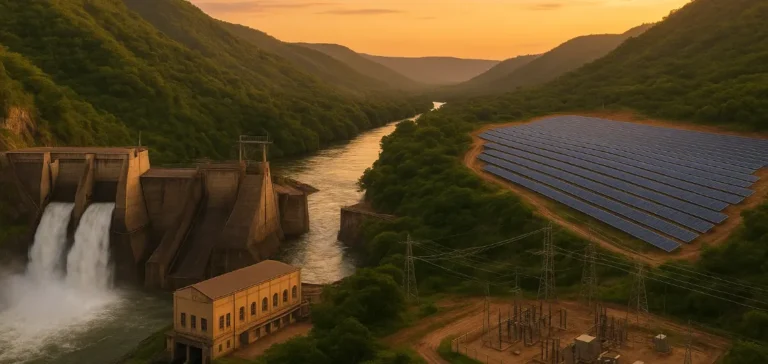

Lunsemfwa Hydro Power Company currently owns two hydropower plants located in Kabwe, Central Province, Zambia, with a combined capacity of 56 megawatts (MW). LHPC is also developing an additional solar photovoltaic project with a capacity of 20 MW. The remaining 49% stake in LHPC continues to be held by Wanda Gorge Investments, a Zambian infrastructure investment company.

LHPC sells electricity generated to Zambia Electricity Supply Corporation (ZESCO) through a Power Purchase Agreement (PPA), as well as to private customers such as Copperbelt Energy Corporation and Jubilee Metals. Additionally, the company holds an electricity trading licence from the Southern African Power Pool (SAPP).

A strategic investment for Globeleq

This transaction represents Globeleq’s first venture into hydropower on the African continent. The acquisition aligns with a broader strategy aimed at diversifying its renewable energy assets, complementing existing assets including solar, wind, Battery Energy Storage Systems (BESS), hybrid systems combining solar and BESS, and geothermal power plants.

Globeleq views Zambia as a strategic growth market, with a portfolio of green projects under development exceeding a combined capacity of 400 MW. Among these projects is the 54 MWp Kafue photovoltaic solar plant awarded under the GETFiT Zambia programme.

Transaction nearing completion

The agreement between Globeleq and Norfund is expected to be completed during the second half of 2025. Jonathan Hoffman, CEO of Globeleq, stated: “LHPC has a skilled and experienced team. Combined with our extensive African expertise, this acquisition will enable us to deliver tailored solutions to Zambia’s energy goals.”

Norfund’s Investment Director, Øystein Øyehaug, specified that Globeleq was chosen for its proven ability to optimise operational performance and develop the acquired company: “We sought an investor capable of efficiently managing existing assets and maximising LHPC’s long-term growth potential. Globeleq perfectly fits these criteria with its established presence and expertise in Africa.”