Energy Vault has announced the acquisition of the Stoney Creek Battery Energy Storage System (BESS), with a capacity of 125 MW and 1,000 MWh, from Enervest Group. This project, with a construction value of 220 million USD, is backed by a 14-year Long-Term Energy Services Agreement (LTESA) awarded by the Australian Energy Market Operator (AEMO) Services. This acquisition is part of Energy Vault’s expansion strategy aimed at increasing the company’s presence in large-scale energy storage in Australia, a key market for the energy transition.

A strategic project for Energy Vault

The acquisition of Stoney Creek is part of a broader effort to diversify and strengthen the assets owned and operated by Energy Vault. The project has a storage capacity that allows for eight hours of dispatchable energy, thus contributing to the stability of the New South Wales electrical grid. This type of storage helps better integrate intermittent renewable energy sources into the grid while supporting Australia’s decarbonization goals.

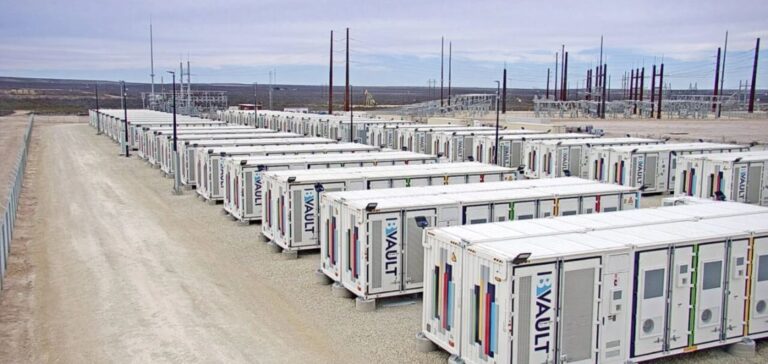

In addition to this acquisition, Energy Vault will continue to develop and integrate the project using its VaultOS™ energy management technology and B-Vault™ architecture, which optimize asset performance and long-term management. The project is expected to generate stable and predictable cash flows, thus strengthening the company’s long-term revenue streams.

The partnership with Enervest

Enervest Group, the Australian project developer, remains involved in the project by providing development services and facilitating relationships with local stakeholders, including the Narrabri Aboriginal Land Council (LALC) and the Gomeroi community. This collaboration is essential to ensure the smooth progression of the project and the successful integration of local concerns into the development process.

The project also benefits from strong local acceptance, which further enhances the long-term viability of the Stoney Creek BESS. Energy Vault and Enervest are working closely to ensure the success of the pre-construction phase, which is expected to begin later this year.

A key market for expansion in Australia

The acquisition of this project allows Energy Vault to expand its portfolio in Australia, one of the most dynamic markets in terms of energy transition and energy storage. Currently, the company manages over 2.6 GWh of energy storage projects in the country, and the addition of Stoney Creek further strengthens its strategic position. This market is benefiting from high demand for long-term energy storage solutions, in line with the country’s decarbonization and energy transition objectives.