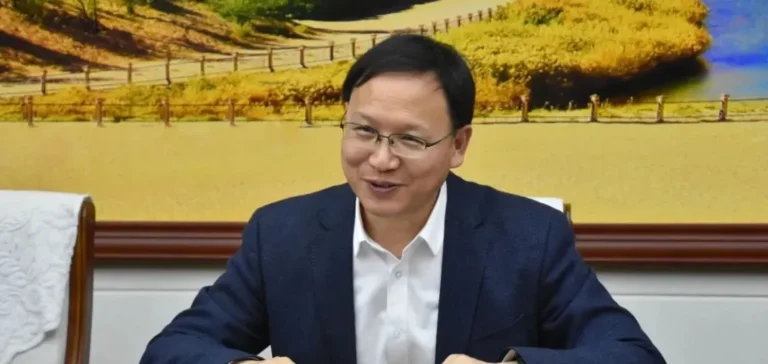

The oil group China National Offshore Oil Corporation Limited (CNOOC Limited) officially announces the appointment of Zhang Chuanjiang as chairman of the board of directors effective July 8, 2025. Concurrently, he will also assume the roles of chairman of the nomination committee and chairman of the strategy and sustainability committee, according to a company press release issued today. This decision comes as CNOOC Limited continues to expand its energy activities internationally, facing growing challenges in the oil and natural gas markets.

Solid expertise in China’s energy industry

Aged 57 and holding an engineering degree, Zhang Chuanjiang is a professor-level senior engineer with solid experience in China’s energy sector. Prior to his appointment as chairman of CNOOC Limited, he notably served as deputy general manager and later general manager of the Ordos Coal-to-Liquids subsidiary of China Shenhua Coal to Liquid and Chemical Co., Ltd. He also served as chairman of this same company before leading the Chemical Industry Operation and Management Centre of China Energy Investment Corporation (CHN Energy).

In recent years, he held various leadership roles within major Chinese energy companies. Between March and July 2020, he was chairman of CHN Energy Ningxia Coal Industry Co., Ltd., before joining China Datang Corporation Ltd., where he served as vice-president until April 2024, and then as director and president until June 2025.

A key role in international strategic deployment

Since June 2025, Mr. Zhang already holds the positions of chairman of China National Offshore Oil Corporation, as well as chairman and CEO of Overseas Oil & Gas Corporation Ltd. and chairman of CNOOC (BVI) Limited. His appointment at the head of CNOOC Limited comes amid intensified international investments by the Chinese oil company, which seeks particularly to strengthen its positions in offshore markets.

The board of directors publicly expressed its congratulations to Zhang Chuanjiang in the official statement released on the occasion of his appointment. CNOOC Limited, listed in Hong Kong and Shanghai, thus continues reorganising its executive structures to better respond to changes in the global energy market.

Governance reshuffled to address market challenges

Founded in 1999, CNOOC Limited specialises in the exploration, extraction, and marketing of oil and natural gas in China and abroad. The company is among China’s leading oil producers, with a strong international presence in over 20 countries.

With this new chairmanship, the company continues to renew its leadership team to face constantly evolving competitive and technological challenges. Zhang Chuanjiang thus succeeds other experienced executives in the Chinese oil sector, confirming a progressive leadership renewal strategy pursued by the group for several years.