China, through the State Power Investment Corporation (SPIC), achieved a record energy production of 707.2 terawatt-hours (TWh) in 2024, marking an increase of 6.11% compared to the previous year. This figure highlights the strategic importance of public investments in the development and optimization of national energy capacities.

Public Investments and Energy Growth

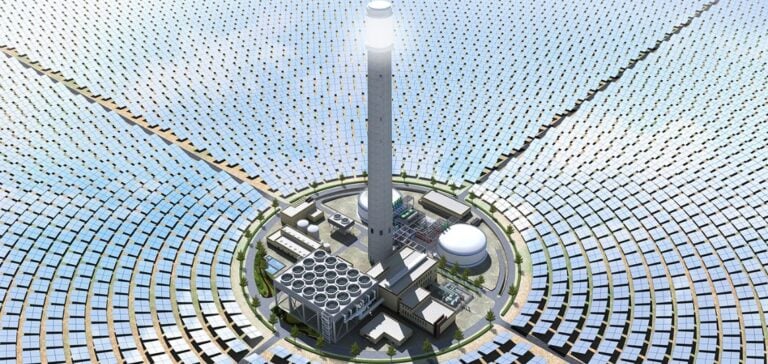

SPIC, one of the main public operators in the energy sector, increased its installed capacity to reach a total of 250 gigawatts (GW) in 2024. Among these installations, 177 GW come from key projects, demonstrating the effective management of public funds to meet the growing energy demand. This expansion is part of a governmental drive to ensure energy autonomy while stimulating the national economy.

Financing Strategies and Asset Management

The public funds allocated to SPIC enabled a dual approach: on the one hand, the development of new energy infrastructures, and on the other, optimized management of existing assets. These initiatives have contributed to stabilizing electrical grids while increasing the profitability of state-funded projects.

Economic and Geopolitical Impacts

SPIC’s performance also highlights the geopolitical implications of China’s public investments. By strengthening domestic production, China reduces its dependence on imports while consolidating its influence on international markets. These results underline the central role of public operators in energy security, which is crucial in a global context marked by tensions over strategic resources.