Recurrent Energy, a subsidiary of Canadian Solar Inc. recently announced the initial closing and funding of an investment by BlackRock, through its Climate Infrastructure fund. This $500 million investment marks a crucial step in Recurrent Energy’s strategic development, aimed at expanding its solar and energy storage projects in key markets such as the United States and Europe.

A strategic investment for sustainable growth

BlackRock, through its Climate Infrastructure Global Renewable Power Fund IV, acquired 20% of Recurrent Energy’s diluted shares. This transaction, first announced in January 2024, was finalized after obtaining the necessary regulatory approvals. It represents the majority of the planned capital infusion, with the aim of reaching a total of $500 million once the transaction is fully completed.

This investment enables Recurrent Energy to strengthen its portfolio of development projects, such as the Liberty solar project, supporting its strategic transition from a simple developer to a long-term owner and operator. This strategic transformation will enable Recurrent Energy to generate more stable long-term revenues in low-risk currencies and capture greater value from its globally diversified project pipeline.

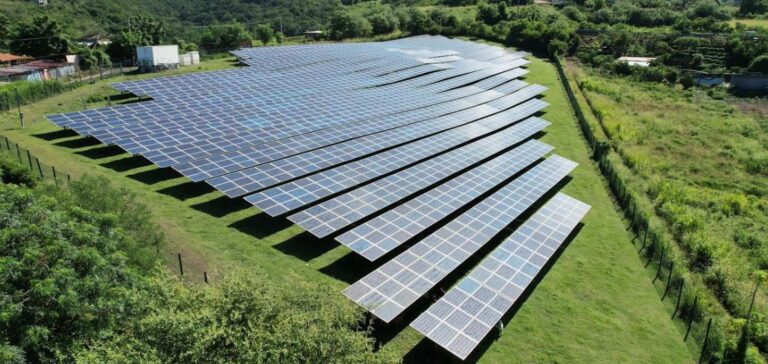

A global platform for clean energy projects

Since its creation in 2009, Recurrent Energy has developed, built and connected over 10GW of solar projects and 3.3GWh of energy storage projects on six continents. As of March 31, 2024, Recurrent Energy had a global project development pipeline of 26GW in solar and 56GWh in storage, of which 11GW and 15GWh respectively are interconnected projects.

Ismael Guerrero, CEO of Recurrent Energy, expressed his satisfaction with this strategic investment, saying that BlackRock’s financial and strategic support would enable the company to advance its key solar and energy storage projects around the world.

Outlook for growth and stability

With this investment, Recurrent Energy plans to have 4GW of solar and 2GWh of storage in operation in the US and Europe by 2026. David Giordano, Global Head of Climate Infrastructure at BlackRock, emphasized that this investment positions Recurrent Energy for growth in the development, construction and management of large-scale solar and energy storage projects in key high-growth markets.

This collaboration reinforces Recurrent Energy’s position as one of the world’s leading clean energy project development platforms, with a team of leading energy experts. BlackRock’s support is seen as a major asset in achieving Recurrent Energy’s strategic objectives and making a significant contribution to the global energy transition.