Aramco, a global energy leader, and Ma’aden, the leading mining company in the Middle East, have signed a preliminary agreement to establish a joint venture focused on the exploitation of transition minerals. This strategic partnership, announced during the Future Minerals Forum in Riyadh, specifically targets lithium, a key component in technologies essential to the energy transition.

A Strategy for the Energy Transition

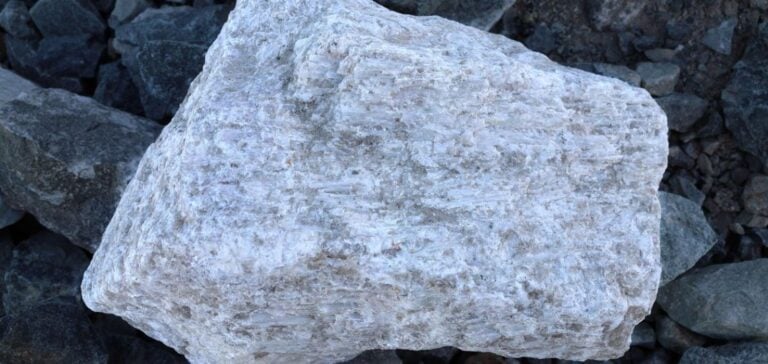

Lithium has become an essential resource for rapidly growing sectors such as electric vehicles, energy storage systems, and renewable energy. Saudi Arabia, rich in natural resources, holds promising deposits identified by Aramco, with lithium concentrations exceeding 400 parts per million in certain exploration areas.

This partnership will leverage the strengths of both companies. Aramco will provide its expertise in geological data management and advanced infrastructure, while Ma’aden will contribute its knowledge in exploration and mining operations. The goal is to develop innovative technologies such as direct lithium extraction (DLE) for efficient and environmentally friendly production as early as 2027.

Meeting Global Demand

Global demand for lithium has tripled over the past five years and is expected to grow at a compound annual rate of more than 15% until 2035. In Saudi Arabia, projected demand for lithium could increase twentyfold between 2024 and 2030, driven by rising needs for batteries in electric vehicles and renewable energy.

This joint venture would not only address domestic needs but also strengthen Saudi Arabia’s position in international markets. By establishing competitive exploitation capabilities, the Kingdom aims to become a key supplier of critical minerals.

An Economic and Geopolitical Dimension

Beyond commercial opportunities, this project holds major strategic significance. Critical minerals such as lithium play a central role in current geopolitical dynamics. With this initiative, Saudi Arabia seeks to reduce its dependence on imports while integrating itself into global supply chains.

This project aligns with the ambitions of Vision 2030, which aims to diversify Saudi Arabia’s economy and reduce its reliance on hydrocarbons. By strengthening its mining sector, the Kingdom aspires to become an essential player in the global energy transition.

Prospects and Conditions

The implementation of this joint venture remains subject to regulatory conditions and feasibility studies. However, the prospects are promising, with significant economic development potential for the Kingdom. If the goals are achieved, this project could not only meet the growing demand for lithium but also position Saudi Arabia as a leader in the transition minerals sector.