- Partenariats commerciaux

- Focus

- Sector Analysis

Sudan seeks partnership with Belarus to rehabilitate its energy grid amid prolonged humanitarian, economic and logistical crisis.

Prolonged attacks on fuel convoys have depleted stocks, destabilised power generation and disrupted economic activity in Bamako and surrounding regions.

Amazon unveils new visuals of its upcoming nuclear site, marking a key step in its partnership with X-energy to deploy up to 960 MW of modular nuclear capacity in Washington state.

EDF’s CEO said electricity prices will remain under control in 2026 as a new pricing system is set to replace the previous mechanism from January 1.

Danish manufacturer Vestas has paused construction of its planned facility in Poland, originally set for 2026, citing weaker-than-expected European offshore wind demand.

AXIAN Energy has acquired a majority stake in the Bangweulu solar plant in Zambia, strengthening its pan-African solar strategy while entering a rapidly growing energy market.

Talks on the Net-Zero Framework, which seeks to regulate greenhouse gas pricing on marine fuels, have been postponed until 2026 following a majority vote initiated by Saudi Arabia.

The Malaysian group launched three tenders to sell up to five liquefied natural gas cargoes in November and December, sourced from its Bintulu and PFLNG Dua facilities.

Nigerian group Dangote has reduced crude supply to its refinery, citing a strategic adjustment to high oil prices and denying any technical failure.

The South African government ends a thirteen-year freeze on shale gas, paving the way for renewed exploration in the Karoo Basin amid a national energy crisis.

A consortium led by Masdar and CPP Investments proposes to acquire all of ReNew at $8.15 per share, representing a 15.3% increase over the initial offer.

Sun Trinity has commissioned a 3.1 MW solar carport in Nara, bringing its on-site PPA capacity with Aeon Mall to 10.1 MW under a nationwide rollout plan across twelve commercial sites.

Platts' physical pricing platform records its second-highest LNG trading volume, with nearly 1.5 million tonnes exchanged despite regional demand slowdown.

Canadian uranium producer NexGen Energy has completed a A$1bn ($639mn) equity raise split between North American and Australian markets to support the development of its Rook I project.

In Kuala Lumpur, Huawei Digital Power unveiled its grid-forming technologies, positioned as a strategic lever to strengthen power interconnections and accelerate energy market development across ASEAN.

Reliance Industries reported a 9.67% increase in net profit in the second quarter of fiscal year 2025–2026, driven by recovering petrochemical margins and continued growth in its retail and telecom operations.

Austrian battery optimisation specialist enspired enters Japan in partnership with Banpu NEXT, backed by a Series B extension to over €40mn.

Tokyo Electric Power Company Holdings is examining the permanent closure of units 1 and 2 at the Kashiwazaki-Kariwa nuclear power plant, the oldest at the site, while continuing efforts to restart unit 6.

Vermont’s energy regulator authorises final review of a 2.2 MW project led by Clean Energy Technologies to convert agricultural waste into renewable electricity.

Standard Lithium a sécurisé $130mn via une émission d’actions ordinaires pour financer ses projets d’extraction de lithium en Arkansas et au Texas, consolidant sa position sur le marché nord-américain des métaux stratégiques.

- Last news

Repsol has launched a pilot platform of AI multi-agents, developed with Accenture, to transform internal organisation and improve team productivity.

SUNOTEC expands in the Bulgarian market with seven projects combining battery and solar, totalling 763 MWh of storage and 115 MWp of photovoltaic capacity.

Daily winter demand spikes are pushing Britain’s gas system to rely more on liquefied natural gas and fast-cycle storage, as domestic production and Norwegian imports reach seasonal plateaus with no room for short-term increases.

Two European Parliament committees propose to advance the full halt of Russian hydrocarbon imports to 2026 and 2027, including oil, gas, and LNG, strengthening the European Union’s geopolitical position.

The Canadian oilfield services provider announced a $75mn private placement of 6.875% senior unsecured notes to refinance bank debt and support operations.

Enedis will progressively reorganise off-peak hour time slots from 1 November, impacting 14.5 million customers by 2027, under new rules set by the Energy Regulatory Commission.

Commercial crude reserves in the United States posted an unexpected increase, reaching their highest level in over a month due to a marked slowdown in refinery activity.

Rising terminal capacity and sustained global demand, notably from China and Europe, are driving U.S. ethane exports despite new regulatory uncertainties.

The rise of data centres, electrification, Asian industrialisation and military spending are reshaping global copper market dynamics, while insufficient mining investment could increase price volatility.

British operator Equitix has been selected to take over transmission assets of the Neart na Gaoithe offshore wind farm, a £450mn ($547mn) project awarded under Ofgem’s tenth tender round.

Energiequelle GmbH has launched replacement work for old turbines at its Minden-Hahlen site, aiming for long-term structural maintenance with the installation of three new 200-metre machines.

Danish fund Copenhagen Infrastructure IV transfers half of its stake in the UK-based Coalburn 2 project to AIP Management, strengthening AIP's energy storage portfolio in the United Kingdom.

Energy logistics firm Exolum launches the UK’s first independent sustainable aviation fuel blending site, supporting a nationwide network expected to supply up to 65,000 flights per year.

Lyten has completed the acquisition of the Northvolt Dwa site in Poland, Europe’s largest energy storage system factory, and plans to deliver its first commercial units before the end of 2025.

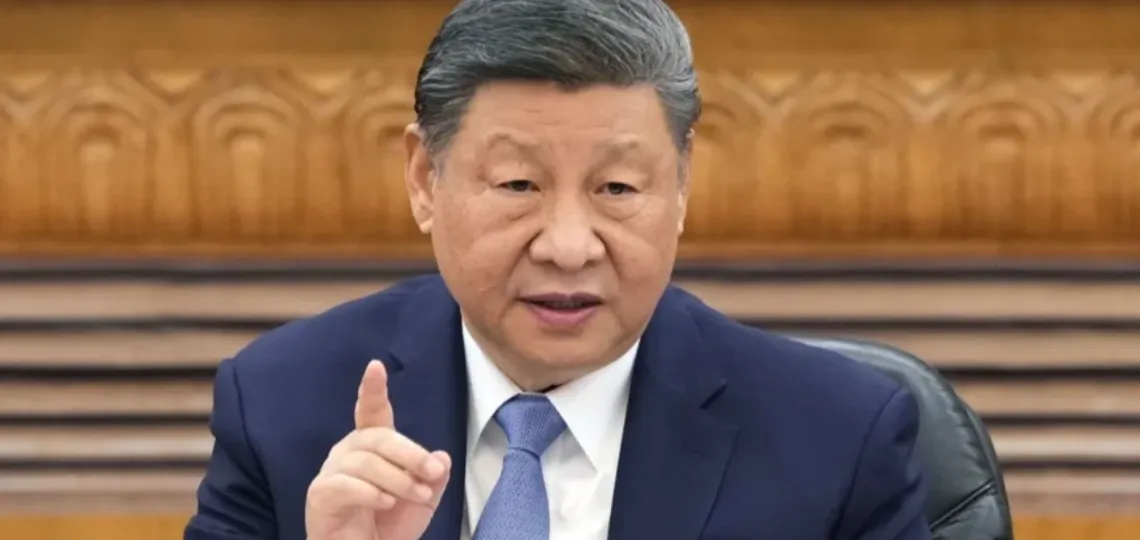

Beijing calls Donald Trump's request to stop importing Russian crude interference, denouncing economic coercion and defending what it calls legitimate trade with Moscow.

The United States has called on Japan to stop importing Russian gas, amid rising tensions over conflicting economic interests between allies in response to the indirect financing of the war in Ukraine.

India faces mounting pressure from the United States over its purchases of Russian oil, as Donald Trump claims Prime Minister Narendra Modi pledged to halt them.

ABB recorded double-digit growth in sales of equipment for data centres, contributing to a 28% increase in net profit in the third quarter, surpassing market expectations.

Australian group Santos lowers its annual production forecast after an unplanned shutdown at the Barossa project and delayed recovery in the Cooper Basin.

SNG Holdings launched trial operations of a 2MW/6MWh energy storage facility in Gotemba, backed by Digital Grid and PHOTON, ahead of commercial commissioning scheduled for November.