The French government has made a major investment in Orano, a company specializing in uranium and nuclear technologies, by subscribing to a capital increase of nearly €300 million. This financial operation, announced by Orano and the Ministry of Economy, is part of the French nuclear industry’s revival and aims to bolster the company’s infrastructure, notably its uranium enrichment plant located in the south of France.

The amount of this capital increase, precisely €299,999,952, was covered by the creation of new shares. In total, 9,146,340 ordinary shares with a nominal value of €0.50 each, along with an issuance premium of €32.30 per share, were issued and fully subscribed by the state. This transaction brings the state’s stake in the company to 90.33%, thereby reducing the shareholding of the Japanese investors, Japan Nuclear Fuel Limited and Mitsubishi Heavy Industries Ltd, whose stakes fall from 5% to 4.83% each.

A Strategic Support for Energy Sovereignty

According to the Ministry of Economy, this financial boost underscores France’s commitment to developing a robust and independent nuclear sector in response to growing demand for decarbonized and sovereign energy sources. “This investment is an essential step in strengthening our nuclear industry to ensure national energy supply and the security of our European partners,” a ministry representative stated.

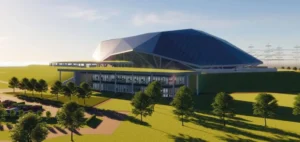

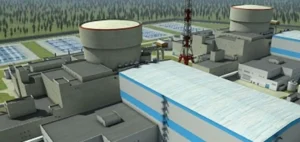

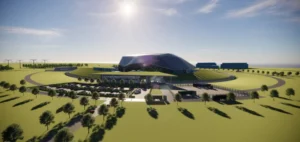

Orano, which manages a complete uranium supply chain, noted that these funds would contribute to the realization of its major industrial projects. Among the priorities is the expansion of the Georges-Besse II uranium enrichment plant, located in Tricastin, which will benefit from a one-third increase in capacity. This expansion aims to capture significant market share in a global context where the demand for enriched uranium is on the rise.

Competition in the Enriched Uranium Market

The global enriched uranium market is currently dominated by four main players: the Russian Rosatom, the European Urenco, the Chinese CNNC, and Orano. With approximately 12% market share, Orano aims to reduce Europe’s dependency on Rosatom, which alone accounts for 43% of the world’s enriched uranium production. Geopolitical tensions, exacerbated by Russia’s invasion of Ukraine in 2022, have reinforced the will of Western countries, notably the United States and the European Union, to diversify their uranium supply sources to lessen their reliance on Rosatom.

Orano thus positions itself as a key player in this sector, supported by uranium resources from partner countries like Canada and Kazakhstan. This diversification of sources is crucial to ensuring continuity in fuel supply for European nuclear plants.

Impact of the Situation in Niger on Production

The decision to invest in expanding capacities in France comes amid challenging conditions for Orano in Africa. Recently, the company announced the suspension of its production in Niger, scheduled for the end of October. Orano justified this decision by citing an inability to reach an agreement with the military government that came to power in July 2023. Niger, rich in uranium resources, has long been a supplier for Orano. However, the current political situation and imposed restrictions have made operations unsustainable, affecting future extraction and transportation prospects for the ore.

The suspension of activities in Niger could present a challenge for Orano in the coming years as global demand for uranium continues to grow. At the same time, this decision underscores the importance of strengthening enrichment capacities on French soil and reducing dependency on uranium imports.

A Nuclear Sector in Transition

Orano’s capital increase is part of a broader strategy to bolster the French nuclear sector. The French government has recently multiplied initiatives to encourage decarbonized energy production and promote energy sovereignty. By investing in Orano, France reaffirms its commitment to supporting a competitive nuclear industry against well-established international competitors.

Orano, for its part, aims to modernize and expand its facilities to meet the growing demand in Europe and limit reliance on foreign sources. This strategy could also allow Orano to capture market share by offering alternatives to European partners seeking to diversify their supplies.