Aventron and Aberdeen Standard Investment merge.

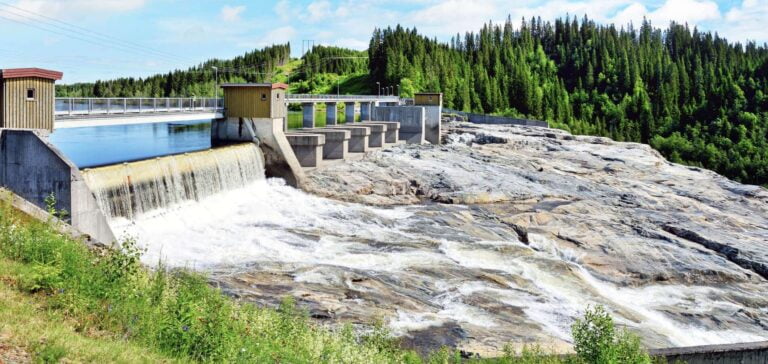

The operation will create Norway’s third-largest operator of small-scale hydroelectric power plants, with an annual production capacity of 460 GWh.

Aventron and ASI share 41 plants for 460GWh

Aventron and Aberdeen Standard Investments (ASI) enter into an agreement to merge their small hydro portfolios.

The agreement will focus on the development, construction, production and distribution of renewable energy through hydro and wind power in Norway.

The combined portfolio comprises 41 small-scale hydroelectric power plants (including one under construction), as well as one operational wind farm and one under construction.

The Group also benefits from a strong pipeline of small-scale hydro and wind projects.

Combined annual production capacity should reach around 460GWh when all projects are fully operational.

Consolidating the small-scale hydropower market in Norway

Norway’s hydropower sector is one of the most developed in the world, with considerable potential for development and consolidation.

With Aventron’s assets mainly located in southern Norway and ASI’s in the north, the two portfolios are highly complementary.

The merger brings geographical diversity, potential for operational synergy and risk reduction through a better long-term competitive position for the joint company.

Aventron has therefore become the majority shareholder of the joint entity, Aventron Norway AS.

ASI, through its first infrastructure fund, SL Capital Infrastructure I LP, will hold a substantial minority position with governance rights.

The joint venture’s ambition is to foster sustainable growth, while consolidating the Norwegian small-scale hydropower market.

It will ensure high safety standards, respect for the environment and operational reliability.